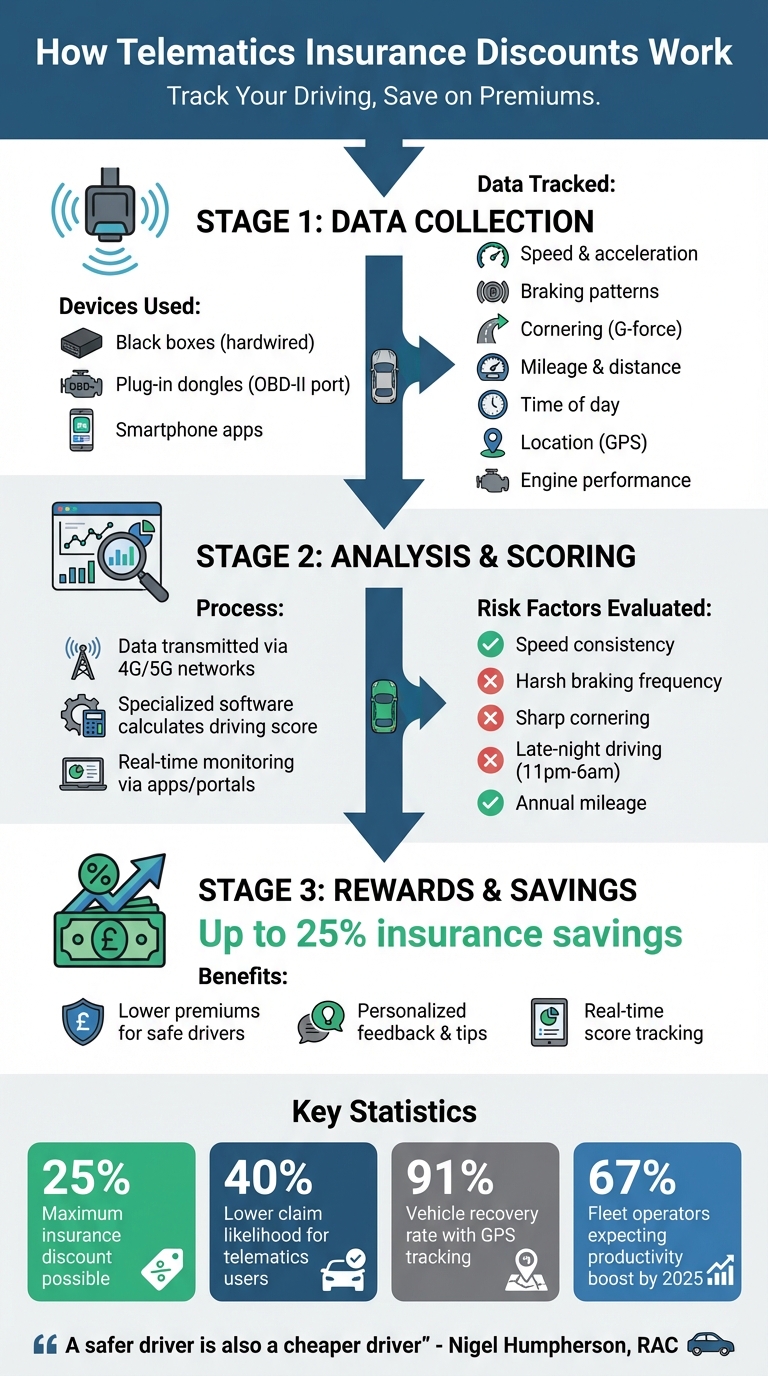

Telematics Insurance Discounts: How They Work

Explains how telematics devices collect driving data, how insurers score behaviour, and how drivers and fleets can cut premiums and improve safety.

Telematics insurance discounts reward safe driving by tracking your habits on the road using devices like black boxes, plug-in dongles, or smartphone apps. Insurers analyse data such as speed, braking, acceleration, mileage, and driving times to calculate a score. A better score often leads to lower premiums - up to 25% savings in some cases.

For businesses, especially fleet operators, telematics not only reduces insurance costs but also improves safety, tracks vehicles, and cuts fuel expenses. It helps prevent fraud, speeds up claims, and ensures timely maintenance. Drivers can monitor their scores via apps and receive tips to improve.

Devices must be installed promptly, and driving habits like avoiding harsh braking and late-night trips are key to qualifying for discounts. Telematics benefits both individual drivers and businesses by promoting safer, more efficient driving while lowering costs.

How Telematics Insurance Works: From Data Collection to Discounts

How Telematics Devices Work

Data Collected by Telematics Devices

Telematics devices rely on a mix of technologies like GPS, accelerometers, and SIM cards to gather a range of driving data. These devices capture details such as location, speed, distance travelled, and sudden movements like harsh braking, rapid acceleration, or sharp cornering by measuring changes in G-force through accelerometers.

Plug-in devices, which connect to the OBD-II port, go a step further by monitoring engine performance and fuel consumption. Hardwired black boxes, on the other hand, can even track a vehicle’s location if it’s stolen, as they can transmit data independently of the vehicle’s main power supply.

This granular data doesn’t just sit idle - it plays a critical role in refining risk assessments. For instance, insurers may penalise driving during high-risk times, such as late at night. By analysing these patterns, insurers gain a clearer picture of driving behaviour and associated risks.

How Insurers Analyse Telematics Data

Once the data is collected, insurers dive into the numbers to evaluate risk and adjust premiums accordingly. Using cellular networks like 4G and 5G, the data is sent to insurers' servers, where specialised software calculates a driving score. This score is based on factors like speed consistency, braking habits, cornering, mileage, and even the timing of journeys.

For example:

- Consistent speeding raises red flags and could lead to policy cancellation.

- Frequent hard braking might indicate a lack of attention or risky driving behaviour.

- Lower annual mileage, on the other hand, often suggests reduced risk, which can translate to lower premiums.

Many insurers now offer mobile apps or online portals where drivers can check their scores in real time. These platforms often provide personalised feedback, such as advice on avoiding sharp braking or steering clear of late-night drives, to help drivers improve their scores and potentially unlock better discounts.

Beyond personal insurance, telematics insights are invaluable for businesses managing vehicle fleets. They help companies promote safer driving habits and improve operational efficiency, making telematics a key tool for enhancing fleet safety and performance.

Eligibility for Telematics Insurance Discounts

Who Qualifies for Telematics Discounts?

Telematics insurance isn’t just for individual drivers - it’s a game-changer for fleet operators too. Whether managing cars, vans, or heavy goods vehicles, fleet managers can use telematics to showcase safer driving habits and cut operational costs. Industries like delivery and logistics, from local couriers to nationwide networks, benefit by optimising routes and presenting a lower risk profile to insurers.

High-risk industries such as the motor trade, scaffolding, and civil engineering are also turning to telematics for more competitive premiums. Similarly, businesses in construction, engineering, and wholesale sectors use this technology to monitor driver behaviour and challenge outdated stereotypes. For fleets with younger drivers (aged 17–25), this can translate into significant savings - premiums can drop by 25% or more within a year, as long as safe driving standards are maintained.

Telematics is also ideal for low-mileage operations. Pay-as-you-drive or pay-per-mile models cater to vehicles used infrequently or for shorter trips. Additionally, commercial van users and motorcycle fleets can qualify for discounts by demonstrating safe driving or riding habits.

Overall, these criteria not only help fleets save money but also improve risk management. Let’s take a closer look at the specific factors that shape eligibility for these discounts.

Factors That Affect Discount Eligibility

Getting a telematics discount isn’t as simple as installing a device. There are certain requirements to meet. For instance, vehicles typically need to be less than 15 years old and valued at a minimum of £250 for cars or £750 for vans. Some insurers also impose minimum mileage thresholds, such as 1,000 miles annually for cars or 1,900 miles for vans, to ensure the policy aligns with how the vehicle is used.

Traditional underwriting factors still play a role too. These include your location, no-claims history, and the age and experience of all drivers. It’s worth noting that every driver authorised to use a vehicle contributes to the overall driving score. So, one person’s harsh braking or late-night trips could impact the entire fleet’s eligibility for discounts. If you’re using a self-install telematics device, it must be fitted within 15 days to avoid policy cancellation.

The data collected - such as speed consistency, braking patterns, cornering, and the time of day you drive - ultimately determines the level of discount you qualify for. However, telematics doesn’t guarantee cheaper insurance. As the Association of British Insurers warns:

"If you frequently drive late at night or on unsafe roads... your insurer may consider you a high-risk driver".

Cost Savings and Business Benefits

Insurance Savings for Fleets

Telematics technology can lead to insurance savings of up to 25% for fleets that consistently demonstrate safe driving behaviours. Insurance providers are now tying premiums directly to driving performance. Drivers who steer clear of speeding, harsh braking, and sharp cornering are rewarded with reduced renewal costs.

For fleets with vehicles that cover fewer miles, pay-per-mile insurance models offer a tailored way to save. Instead of a standard flat premium, these fleets pay based on the actual distance driven - perfect for vehicles used sporadically or for shorter journeys.

Operational Benefits Beyond Insurance

The advantages of telematics extend far beyond insurance discounts. These systems improve overall fleet efficiency by identifying fuel-wasting habits like excessive idling or aggressive driving, helping businesses cut fuel costs. Real-time engine diagnostics also play a key role, flagging minor issues before they turn into costly repairs. This not only reduces downtime but also extends the lifespan of vehicles.

Other operational perks include better GPS tracking, which streamlines dispatching and route planning, and automated reporting that simplifies administrative tasks. By 2025, 67% of fleet operators expect telematics to significantly boost productivity. Additionally, 64% of users report improved compliance with tachograph regulations, as telematics systems monitor drivers’ hours to avoid penalties.

Telematics also enhances theft recovery, with 59% of users reporting higher recovery rates due to GPS tracking. Another critical benefit is the availability of objective driving data, which can be used to protect businesses from fraudulent "crash for cash" claims.

These operational improvements highlight the importance of selecting the right telematics solution for your fleet.

GRS Fleet Telematics: Helping Fleets Save

GRS Fleet Telematics provides advanced tracking solutions tailored to UK fleets, enabling them to qualify for insurance discounts while improving daily operations. By combining cost savings with operational efficiency, GRS has become a trusted partner for fleet managers.

Our dual-tracker technology offers real-time location updates, enabling smarter route planning and reduced fuel consumption. The driver monitoring system identifies risky behaviours like harsh braking and rapid acceleration, helping to lower accident risks.

With a 91% recovery rate for stolen vehicles, GRS systems also protect fleets from total loss claims. The integrated data offers detailed insights into driver behaviour, providing essential evidence to counteract fraudulent insurance claims. Preventive maintenance alerts further minimise unexpected breakdowns, keeping vehicles on the road and reducing repair costs.

Starting at just £7.99 per vehicle per month, GRS Fleet Telematics offers an affordable way for fleets to promote safe driving and secure lower premiums.

"A safer driver is also a cheaper driver" - Nigel Humpherson, Head of Commercial and Connected Solutions at RAC.

How to Maximise Your Telematics Insurance Discounts

Tips for Improving Driving Scores

Want to secure better insurance rates? Start by fine-tuning your driving habits. Avoid rapid acceleration, harsh braking, and sharp cornering. Stick to safe following distances and ease into starts at junctions. Using tools like cruise control or speed limiters can help you maintain steady, legal speeds.

Timing your journeys can also make a big difference. Try to avoid driving between 11:00pm and 6:00am, as well as during rush hour. Where possible, plan routes that favour motorways over congested urban roads. These adjustments not only improve your driving data but also lower your risk on the road.

Telematics systems have become smarter, now detecting phone usage - a critical factor considering distracted driving rose by over 30% between February 2020 and February 2022. To combat this, use hands-free kits or activate "Do Not Disturb" modes while driving. It’s worth noting that drivers with telematics-based policies are 40% less likely to file claims. Regularly reviewing your telematics dashboard can also help. Spot patterns, like frequent harsh braking at specific junctions, and use that insight to make improvements. Setting up reward systems for high driving scores or incorporating driver training programmes can lead to noticeable premium reductions.

Once you've optimised your driving habits, the key is to choose a telematics system that fully supports these efforts.

Choosing the Right Telematics Solution

To maximise your insurance discounts, invest in a telematics system that goes beyond basic tracking. Look for one that not only monitors key driving behaviours but also provides actionable feedback and theft recovery features. Systems with built-in GPS and on-board diagnostics are particularly valuable.

Driver feedback tools are crucial - opt for a system with an intuitive app or portal that offers practical tips to improve safety. On-board diagnostics can also help by monitoring engine performance, reducing the risk of breakdowns and ensuring vehicles meet safety standards. These features make your fleet less risky in the eyes of insurers.

For example, GRS Fleet Telematics offers a comprehensive solution at just £7.99 per vehicle per month. Its dual-tracker technology provides real-time location updates for route optimisation, while monitoring driver behaviours like harsh braking and rapid acceleration. With an impressive 91% recovery rate for stolen vehicles and detailed data to support claims disputes, GRS systems help fleets secure maximum insurance discounts while streamlining daily operations. Plus, they offer free professional installation when bundled with fleet branding services, making it easy to outfit your entire fleet with reliable, cutting-edge technology.

Insurance Telematics Discount

Conclusion

Telematics insurance discounts are reshaping how premiums are calculated, shifting the focus from general demographics to rewarding safe driving behaviours. Fleets that consistently demonstrate careful driving can unlock premium reductions, with the British Insurance Brokers' Association reporting that discounts of up to 25% are possible. These savings pave the way for wider operational improvements.

But it’s not just about saving on insurance. Telematics brings a wealth of operational perks. By streamlining routes, cutting fuel consumption, enabling timely maintenance, improving theft recovery, and providing reliable evidence in accidents, telematics transforms fleet management. Take GRS Group, for example - a major UK construction materials supplier. In May 2022, they rolled out a telematics system across more than 100 company vehicles in partnership with HDI Global. The results? A 75% decrease in at-fault collisions and an 18% drop in speeding incidents over comparable periods.

The GRS Fleet Telematics programme offers comprehensive tracking with dual-tracker technology, real-time location updates, and driver monitoring, starting at just £7.99 per vehicle per month. With a recovery rate of 91%, it not only helps secure discounts but also enhances operational efficiency. The formula for success includes selecting a system that delivers actionable insights, rewarding safe driving practices, and routinely analysing performance data to uncover areas for growth. By adopting telematics, fleet operators can reduce insurance costs while boosting efficiency and improving safety across the board.

FAQs

How do telematics devices track your driving and share data with insurers?

Telematics devices, often resembling compact black boxes, gather detailed driving information by integrating with your vehicle’s onboard systems and leveraging GPS technology. These devices keep track of crucial metrics such as your location, speed, acceleration, harsh braking, cornering, and mileage. They also monitor engine performance, fuel consumption, and overall driving habits, offering a comprehensive view of when, where, and how you drive.

The data collected is sent to insurers through a built-in SIM card, which uses the mobile network to transmit information almost instantly. If the signal is weak, the device temporarily stores the data and uploads it later. Insurers then analyse this information to build a driving profile and assign a score, which can influence premiums or even lead to discounts.

GRS Fleet Telematics employs similar cutting-edge technology in its van-tracking solutions, supporting UK businesses in managing their fleets more efficiently while potentially unlocking insurance benefits.

What affects your eligibility for telematics insurance discounts?

Your chances of qualifying for telematics insurance discounts hinge on a mix of your driving habits and personal details. Insurers pay close attention to factors like your speed, how smoothly you accelerate and brake, the times of day you drive, and the types of roads you typically use. Alongside these, traditional elements such as your age, driving experience, location, no-claims bonus, and chosen voluntary excess also play a part.

Telematics technology tracks your driving behaviour, allowing insurers to tailor discounts that reward careful and responsible driving. This not only helps you save money on your insurance premium but also promotes safer practices behind the wheel.

How can businesses save money on insurance with telematics technology?

Telematics technology offers businesses a smart way to cut down on insurance expenses by providing detailed insights into driving habits. Insurers can use this data to assess risk more precisely, often rewarding safe driving with premium discounts of up to 25%. Sharing this information with drivers not only promotes safer practices - like reducing speeding or harsh braking - but also helps lower claims and renewal costs over time.

But the benefits of telematics don’t stop at insurance savings. It’s a powerful tool for boosting fleet efficiency. From optimising routes and reducing fuel consumption to identifying maintenance needs early, telematics helps minimise downtime and repair costs. Affordable options, such as dual-tracker van units from GRS Fleet Telematics, allow UK businesses to tap into these advantages for just £7.99 per month. This makes managing fleets simpler and more cost-effective, delivering savings across multiple areas.