Regulatory Barriers to V2G Adoption

How inconsistent grid rules, high standing charges and hardware incompatibility in the UK, EU and North America slow V2G adoption and what policy changes are needed.

Vehicle-to-Grid (V2G) technology allows electric vehicles (EVs) to send unused electricity back to the grid, helping balance energy demand and supply. This could save the UK energy system £2.25 billion annually by 2040 and cut individual EV owners' electricity bills by up to 43% when paired with home solar panels. However, regulatory challenges are slowing progress. These include inconsistent grid connection rules, high standing charges, and limited compatibility between EVs and chargers.

Globally, regions face similar hurdles. The EU struggles with fragmented regulations and double taxation on stored energy. North America deals with state-by-state inconsistencies and limited financial incentives. Addressing these issues - like standardising hardware and simplifying grid access - is key to unlocking V2G’s full potential.

V2G - Implementation, regulation and grid requirements | California & The Netherlands

1. United Kingdom

The adoption of Vehicle-to-Grid (V2G) technology in the UK is not without its hurdles. Issues like fragmented grid connections, high standing charges, hardware incompatibilities, and delays in securing land access make the process challenging.

Fleet operators face the daunting task of navigating the requirements of 14 different Distribution Network Operator (DNO) licensees across Great Britain, each with its own application procedures. This patchwork approach creates significant administrative headaches, especially for businesses operating across multiple regions. Even after installation, delays in "energisation" by DNOs can hold up revenue generation for months. However, there has been some progress: in October 2024, the National Energy System Operator offered 22GW of improved connection agreements for generation and storage projects, with 10.4GW accepted by developers. This step is expected to fast-track these projects by an average of six years. The Office for Zero Emission Vehicles has also emphasised:

"the grid connection process for EV charging infrastructure must enable the transition to EVs".

But while these efforts are promising, the grid connection process remains a significant obstacle.

The financial landscape adds another layer of complexity. In April 2023, the Targeted Charging Review introduced fixed standing charges based on installed capacity rather than usage. These charges, divided into 21 bands, often penalise businesses that invest early in V2G infrastructure before widespread demand materialises. This shift in cost recovery poses a serious financial challenge for operators installing high-capacity systems.

On the technical side, hardware compatibility remains a critical issue. Most sites in the UK rely on single-phase AC chargers, while V2G systems require DC bi-directional chargers. Currently, the CHAdeMO connector is the leading standard for V2G, but it is not supported by all vehicle models. Adding to this, the Electric Vehicles (Smart Charge Points) Regulations 2021 require all new chargers to meet strict standards for cybersecurity (ETSI EN 303 645), interoperability, and demand-side response capabilities. These regulations, while necessary, increase compliance costs for operators.

Another significant bottleneck is the process of securing "wayleaves" for network equipment installation. This outdated system, originally designed long before the rise of EV infrastructure, often involves complex terms or high fees demanded by landowners. For depot-based V2G systems that require substations or extensive cabling, these delays can become a major roadblock.

All these factors combined illustrate the multifaceted challenges that the UK must address to ensure a smoother path for V2G adoption.

2. European Union

In the European Union, the road to V2G (vehicle-to-grid) adoption is anything but smooth, with regulations differing widely across member states. Many distribution grids were originally designed for one-way power flow, and most distribution system operators (DSOs) lack the expertise to handle the complexities of two-way electricity exchange. This technical gap directly impacts financial feasibility and market access for V2G systems.

The financial outlook for V2G in Europe is particularly challenging. In Nordic countries, for example, taxes and network costs make up a significant share of electricity prices - 87% in Denmark, 70% in Iceland, Norway, and Sweden, and 60% in Finland. These high fixed costs leave little room for financial incentives for V2G users. On top of that, double taxation on stored electricity further eats into potential profits, discouraging wider participation.

When it comes to standardisation, the CHAdeMO DC connector is currently the most prominent standard supporting V2G. However, it is far from universally adopted and is rarely compatible with home charging setups, which typically rely on single-phase AC power. The EU has taken steps to address these issues: in April 2025, Commission Delegated Regulation (EU) 2025/656 was introduced to standardise vehicle-to-grid communication and wireless recharging. Despite this progress, hardware compatibility remains a stumbling block, with various vehicle models and charging infrastructure struggling to align.

Market access adds another layer of complexity. Existing regulations often fail to provide clear guidelines for how small-scale energy resources, such as electric vehicles, can participate in wholesale energy markets. This leaves individual EV owners unable to combine their storage capacities to meet the minimum market entry thresholds. A recent industry report highlighted the problem:

"Without bidirectional charging, the terawatt-hours of batteries coming to Europe each year inside electric vehicles could be stranded assets 90% of the time when the vehicles are parked idle".

Additionally, while 85% of mobility experts are open to discussing the benefits of V2G, only 23% are able to propose concrete policy solutions, revealing a significant knowledge gap. Addressing these financial, technical, and regulatory challenges is essential for unlocking V2G’s potential.

A glimpse of what’s possible was demonstrated by the 2017 Parker project in Frederiksberg, Denmark. This initiative used 10 Nissan vans to deliver frequency regulation services to the grid, marking the first commercial V2G test in Europe. The project proved that V2G could work in a competitive market. However, scaling such successes across the EU will require unified grid codes, clearer collaboration between DSOs and TSOs, and an end to the regulatory fragmentation that currently hinders progress.

3. United States and Canada (North America)

The journey towards Vehicle-to-Grid (V2G) adoption in North America is anything but straightforward. The region grapples with a fragmented regulatory framework that varies widely across states, provinces, and even individual utility companies. In the United States, this inconsistency manifests as a "patchwork" system, where interconnection rules differ from one jurisdiction to another. This lack of standardisation not only complicates the process of connecting V2G equipment to the grid but also drives up costs and causes delays. Adding to the challenge are non-uniform hardware standards, such as limited support for CHAdeMO chargers, which further hinder integration. As Steve Letendre, PhD, from V2G News, succinctly puts it:

"V2G progress will hinge on institutional coordination and policy alignment, not just hardware innovation".

Navigating these obstacles requires states to address evolving technical standards and certifications, but there is no unified framework guiding how V2G-enabled technology should be incorporated into local regulations. The Vehicle-Grid Integration Council highlights the resulting friction:

"The emerging patchwork of customer programs, utility rates, interconnection procedures... can generate friction in the deployment process".

This regulatory maze feeds into broader financial and market challenges, making progress even more complex.

Financial and Market Challenges

Financial incentives for V2G in North America are inconsistent at best. The Inflation Reduction Act of 2022 introduced federal tax credits of up to £780 (approximately $1,000) for residential bidirectional chargers and £77,900 (approximately $100,000) for commercial installations. However, these credits are geographically limited, often restricted to low-income or rural areas, unlike the more structured incentives seen in the EU. Compounding this, the U.S. faces a £53.4 billion (approximately $68.5 billion) annual shortfall in fuel tax revenue as more drivers transition to EVs. This financial gap could lead to the introduction of new taxes, such as vehicle miles travelled (VMT) taxes, adding another layer of complexity.

On top of that, both the U.S. and Canada have ambitious zero-emission vehicle (ZEV) targets, but their timelines differ. For example, 17 U.S. states have set a goal of 35% ZEV sales by 2026, while Canada aims for 20% in the same timeframe. Despite these targets, neither country has developed a comprehensive framework for recycling or disposing of EV batteries. Experts predict that the U.S. will need to expand its electrical grid capacity by 30% over the next two decades to accommodate widespread EV adoption - a monumental task that must align with V2G integration.

The Road Ahead for V2G in North America

The integration of V2G technology sits at the intersection of two heavily regulated sectors: automotive and electric power. This overlap makes effective coordination a significant challenge. Without market mechanisms that properly value the grid services EVs can provide, the economic viability of V2G remains uncertain. Pilot projects frequently encounter delays due to unclear interconnection procedures and certification processes, stalling efforts to scale up in the region.

For North America to realise the full potential of V2G, it must address these regulatory and market barriers. Aligning policies with the more streamlined approaches seen in the UK and EU could provide a clearer path forward, paving the way for wider adoption and integration.

Pros and Cons

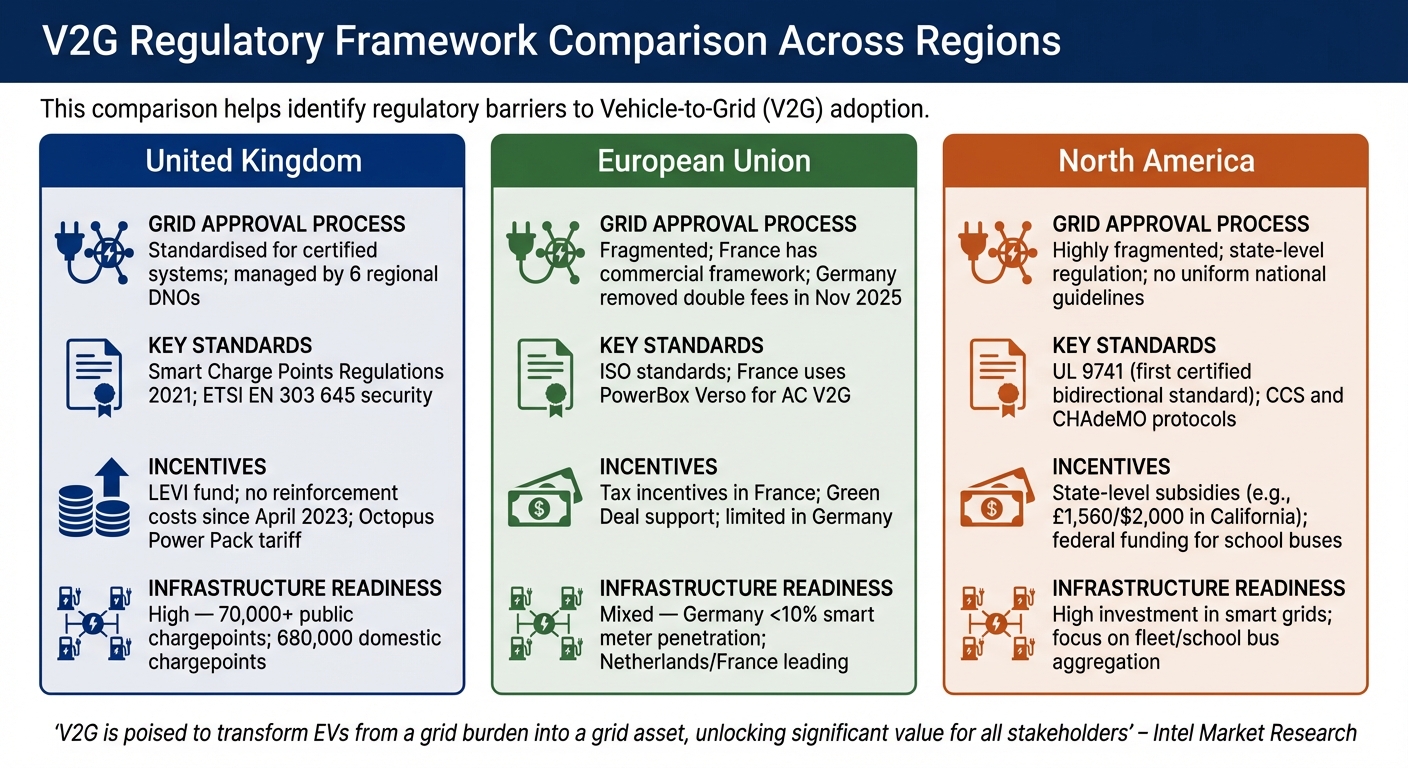

V2G Regulatory Framework Comparison: UK vs EU vs North America

Looking at how different regions handle regulations for Vehicle-to-Grid (V2G) technology reveals a mix of benefits and challenges that influence how quickly this technology can be adopted. In the UK, there are standardised procedures for connecting to the grid, but fixed standing charges can discourage early investments in high-power V2G setups.

In the European Union, the picture is more fragmented. France took a significant step in late 2024 by launching V2G services for private consumers through the Renault 5 and tailored energy contracts. Germany, on the other hand, removed its controversial "double grid fees" in November 2025, which had previously taxed energy both when entering and leaving the battery. However, the rollout of smart meters in Germany remains sluggish, with less than 10% penetration. Denmark has also been a leader in showcasing V2G advancements.

North America presents an even more fragmented regulatory environment, with rules varying widely between states and no unified national framework. California is leading some initiatives, such as the Emergency Load Reduction Program (ELRP), which has piloted V2G projects and shown modest annual returns. The region is also focusing on integrating V2G technology into electric school buses, with manufacturers like Blue Bird and Lion providing large battery capacities that can help stabilise the grid.

The table below highlights key differences in V2G implementation across regions:

| Factor | United Kingdom | European Union | North America |

|---|---|---|---|

| Grid Approval Process | Standardised for certified systems; managed by 6 regional DNOs | Fragmented; France has a commercial framework; Germany removed double fees in Nov 2025 | Highly fragmented; state-level regulation; no uniform national guidelines |

| Key Standards | Smart Charge Points Regulations 2021; ETSI EN 303 645 security | ISO standards; France uses PowerBox Verso for AC V2G | UL 9741 (first certified bidirectional standard); CCS and CHAdeMO protocols |

| Incentives | LEVI fund; no reinforcement costs since April 2023; Octopus Power Pack tariff | Tax incentives in France; Green Deal support; limited in Germany | State-level subsidies (e.g., £1,560/$2,000 in California); federal funding for school buses |

| Infrastructure Readiness | High - 70,000+ public chargepoints; 680,000 domestic chargepoints | Mixed - Germany <10% smart meter penetration; Netherlands/France leading | High investment in smart grids; focus on fleet/school bus aggregation |

As Intel Market Research aptly states:

"V2G is poised to transform EVs from a grid burden into a grid asset, unlocking significant value for all stakeholders".

However, achieving this transformation will require each region to tackle its regulatory hurdles while building on its existing capabilities.

Conclusion

Denmark and the United Kingdom are at the forefront of global efforts to adopt vehicle-to-grid (V2G) technology, while Norway - despite leading Europe in electric vehicle (EV) ownership - faces unique economic challenges. Denmark's success is largely tied to its wind-dominated energy grid, which benefits from the quick-response storage that V2G provides. Meanwhile, the UK's progress has been driven by forward-thinking policies like the Automated and Electric Vehicles Act 2018 and the Electric Vehicles (Smart Charge Points) Regulations 2021. These regulations have laid a strong foundation by mandating smart functionality, interoperability, and cybersecurity standards (ETSI EN 303 645) for private chargers. On the other hand, Norway's reliance on low-cost hydroelectric power makes V2G less competitive as a solution for frequency regulation.

To overcome the hurdles discussed earlier, policy changes are now more important than ever. For the UK to speed up V2G adoption, one key step is revising vehicle approval regulations to ensure all new EVs come equipped with bidirectional-capable onboard chargers. At present, this feature is only available in a limited range of models, which restricts the technology's growth.

Financially, the potential benefits are hard to ignore. By 2040, UK EV drivers could save an estimated £190 annually with bidirectional charging - or even double that amount, around £380 per year, when paired with home solar panels. On a larger scale, V2G could deliver savings of £2.25 billion per year to the UK energy system and enable the country's EV fleet to supply up to 3% of its annual electricity needs.

However, ensuring the grid is ready and accessible remains a critical piece of the puzzle. Reforming electricity taxes and network costs - which can make up as much as 60% to 87% of consumer prices in some regions - will send clearer price signals to encourage flexible energy storage. Additionally, standardising communication protocols across all EV models and charger brands is essential to avoid proprietary systems and to ensure long-term operational compatibility for fleet operators. These regulatory updates are key to unlocking the full potential of V2G technology and building a more integrated, future-focused energy market.

FAQs

What are the key regulatory challenges to adopting vehicle-to-grid (V2G) technology in the UK?

One of the biggest hurdles for vehicle-to-grid (V2G) technology in the UK is that current laws treat electric vehicle (EV) charging as a one-way process, not a bidirectional one. Key regulations, like the Automated and Electric Vehicles Act 2018 and the Electric Vehicles (Smart Charge Points) Regulations 2021, focus mainly on smart charging and data handling. However, they fall short of providing clear standards or legal definitions for bidirectional energy flow. This lack of clarity creates uncertainty for V2G providers, leading to inconsistent requirements and increased compliance costs.

Another major challenge lies in the grid-connection process, which is both complicated and expensive. Getting connection licences, proving grid capacity, and meeting requirements set by network operators can take a lot of time - especially for large-scale V2G installations that put extra strain on local networks. On top of this, while charge points must comply with safety and security standards, there are no concrete market rules or tariffs to reward V2G services for helping with grid flexibility. These regulatory and infrastructure gaps make it harder to roll out V2G technology effectively across the UK.

How do EU and North American regulations for vehicle-to-grid (V2G) differ?

The way vehicle-to-grid (V2G) adoption is regulated differs greatly between the EU and North America. In the EU, binding regulations are in place, including mandatory technical standards for V2G communication and wireless charging. These measures create a consistent framework across all member states, ensuring systems work smoothly together and reducing market fragmentation. This unified approach also supports seamless cross-border V2G services, making it easier for the technology to thrive.

North America, on the other hand, takes a more fragmented route. It relies on a mix of federal programmes, state-level initiatives, and voluntary guidelines. While federal agencies do offer incentives and research roadmaps, the lack of a single standard means rules and specifications vary from state to state. This decentralised setup can pose challenges for widespread V2G adoption, especially when compared to the EU's more streamlined framework.

What financial incentives are available for adopting vehicle-to-grid (V2G) technology in different regions?

Financial rewards for adopting vehicle-to-grid (V2G) technology differ widely depending on where you are. In the UK, users can already make over £1,500 a year by selling stored electricity back to the grid. Households with high energy usage - especially those equipped with solar panels or heat pumps - could save up to £200 a month using V2G. These earnings are tied to market tariffs rather than direct government subsidies, but future government initiatives are expected to help lower installation costs.

Across Europe, governments are ramping up funding for pilot projects and introducing systems to financially reward bidirectional charging. For instance, France has rolled out national programmes that compensate electric vehicle owners who contribute to grid stability. In contrast, in countries like India and Australia, the focus remains on corporate-led pilot schemes and regulatory discussions, with fewer concrete incentives currently available.

In summary, the UK stands out with clear revenue-based benefits for individuals, Europe prioritises broader market-driven rewards, and emerging markets are still in the early stages of exploring V2G possibilities.