Reducing Fleet Accident Costs with Telematics

Telematics reduces fleet accident costs by improving driver behaviour, preventing collisions, speeding up claims and cutting insurance, fuel and downtime.

Fleet accidents are costly, with average claims reaching £20,000 in the UK. Hidden costs like downtime, rising insurance premiums, and legal fees add to the burden, especially for SMEs. Telematics offers a practical way to reduce these expenses by improving driver behaviour, preventing collisions, and streamlining claims management.

Key benefits of telematics include:

- Fewer accidents: A 20% reduction in incidents is common, with some fleets cutting claims costs by up to 96%.

- Lower insurance premiums: Insurers reward fleets using telematics with better terms.

- Operational savings: Reduced fuel consumption, maintenance costs, and downtime.

Systems like AI-powered dash cameras, real-time monitoring, and route optimisation help businesses save money while improving fleet safety. Success stories, such as Royal Mail's £1.5 million in annual claim savings, highlight the value of telematics in managing fleet risks effectively.

Inside the AI Platform Saving Millions in Fleet Accidents

The True Cost of Fleet Accidents

Fleet Accident Costs Breakdown: Direct and Indirect Expenses

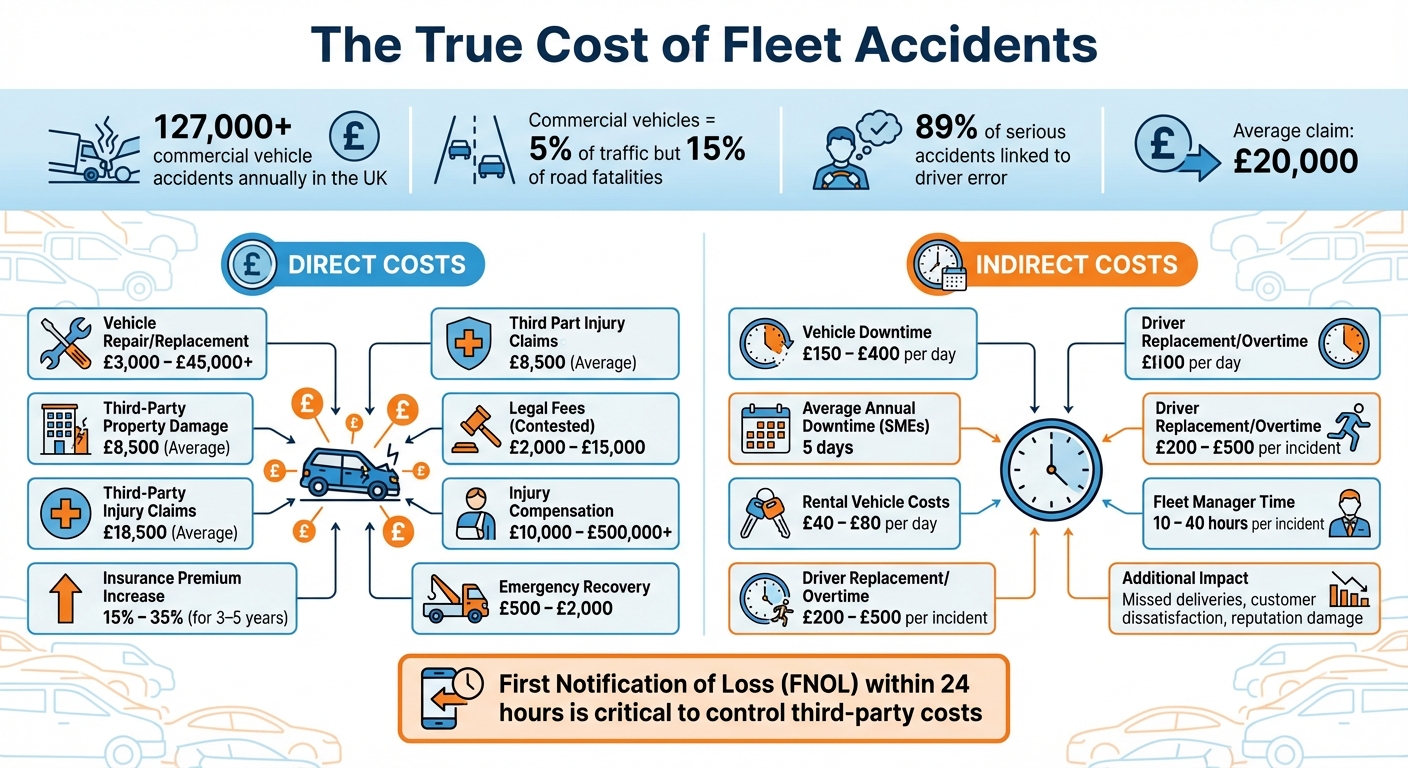

Fleet accidents come with a hefty price tag that stretches far beyond repair bills. In the UK, over 127,000 commercial vehicle accidents occur annually. Shockingly, while commercial vehicles make up only 5% of total traffic, they are involved in 15% of all road fatalities.

Direct Costs: Insurance Claims and Repairs

The immediate financial impact of an accident is significant. Vehicle repairs alone can range from £3,000 to over £45,000, depending on the severity. Emergency services add another £500 to £2,000 per incident. Third-party property damage claims average £8,500, and when injuries are involved, costs jump to an average of £18,500.

Insurance costs also escalate. Premiums can rise by 15% to 35% for three to five years, and fleets often lose their no-claims bonuses. Legal fees for contested cases range from £2,000 to £15,000, while serious injury compensation claims can skyrocket from £10,000 to over £500,000. Alarmingly, 89% of serious commercial vehicle accidents are linked to driver error, suggesting that many of these expenses could be avoided.

| Cost Category | Estimated Expense Range |

|---|---|

| Vehicle Repair/Replacement | £3,000 – £45,000+ |

| Third-Party Property Damage | £8,500 (Average) |

| Insurance Premium Increase | 15% – 35% (for 3–5 years) |

| Legal Fees (Contested) | £2,000 – £15,000 |

| Injury Compensation | £10,000 – £500,000+ |

| Emergency Recovery | £500 – £2,000 |

Indirect Costs: Operational Disruption and Downtime

The ripple effects of fleet accidents disrupt operations significantly. Vehicle downtime alone costs between £150 and £400 per day in lost productivity, and UK SMEs typically face five days of downtime annually. Hiring rental vehicles during repairs adds £40 to £80 per day, while driver replacement and overtime costs range from £200 to £500 per incident.

Fleet managers also bear the burden, often spending 10 to 40 hours managing accident-related tasks - time that could be better spent on core responsibilities. Missed deliveries, delays, and emergency logistics further strain operations, damaging customer satisfaction and long-term reputation. Delayed accident reporting only worsens the situation; insurers stress the importance of first notification of loss (FNOL) within 24 hours to control third-party costs effectively.

These figures highlight the far-reaching consequences of fleet accidents, setting the stage for the next section on how telematics can help prevent such incidents proactively.

How Telematics Prevents Fleet Accidents

Telematics has become a game-changer in fleet safety, moving beyond just cutting costs to actively preventing accidents. By monitoring driver behaviour in real time, identifying risky patterns, and intervening when needed, telematics directly addresses driver errors before they result in incidents.

Real-Time Driver Monitoring and Alerts

Telematics systems keep an eye on high-risk behaviours like harsh acceleration, tailgating, speeding, and even forgetting to wear a seat belt. Drivers receive instant in-cab alerts, giving them the chance to correct their actions on the spot. Over time, this consistent feedback encourages safer driving habits.

For fleet managers, this data is gold. It helps pinpoint drivers who need extra training and even enables gamification - think leaderboards and reward programmes that promote a safety-first mindset through friendly competition. Interestingly, about 35% of UK businesses have used telematics data to contest accident claims or speeding fines, with 18% successfully proving their driver wasn’t at fault.

"Telematics takes guesswork out of the equation when carrying out staff and risk assessments. If a driver is working quickly, telematics will help to determine if they are efficient, or speeding."

– Chris Salmon, Director, Quittance Legal Services

With some providers estimating a 20% drop in accidents after implementation, many fleets report seeing these results within the first year.

Geofencing and Route Optimisation

Telematics doesn’t stop at monitoring drivers - it also uses tools like geofencing and route optimisation to further reduce risks. Geofencing creates virtual boundaries that can help prevent unauthorised vehicle use or driving during high-risk times, such as late at night when fatigue-related accidents are more likely. Meanwhile, route optimisation dynamically steers drivers away from hazards like bad weather or heavy traffic.

These features don’t just make roads safer; they also save money. In a survey of 500 firms, 58% reported fewer speeding fines thanks to telematics, while 47% enjoyed reduced insurance premiums. Insurers appreciate these proactive measures, often rewarding fleets with better coverage terms and lower costs tied to accidents.

AI-Powered Dash Cameras for Risk Mitigation

Adding another layer of protection, AI-enhanced dash cameras take safety to the next level. These cameras use dual-facing lenses to monitor both the road and the driver. They’re smart enough to detect distracted behaviours - like looking at a phone - or signs of fatigue, such as drowsiness. When these risks are spotted, the system issues immediate alerts, giving drivers a chance to adjust before something goes wrong.

What’s more, these cameras can differentiate between driver errors and unavoidable situations, like sudden braking to dodge a pedestrian. This ensures fair assessments and provides footage for coaching drivers based on real incidents.

The results speak for themselves. Between 2024 and 2025, HATS Group installed Lytx Surfsight AI-12 dash cameras across 13 vehicles and saw a 78% drop in incident frequency and a 96% cut in incident costs - from £30,000–£35,000 down to just £1,500. Seat belt violations fell by 74%. Similarly, Sysco GB introduced AI-powered dash cams to over 2,000 vehicles and reduced road accidents by 40% within three months, slashing insured costs by 15%.

"As soon as an accident occurs, we can contact the relevant insurance company with tangible evidence within an hour. A quick reaction time means cases don't drag on and we get a resolution much faster."

– Paul Duncalf, Safety, Training and Fleet Compliance Director, Sysco GB

With distracted driving linked to around 80% of road incidents, these AI-powered systems offer a 20–30% improvement in overall driving behaviour, making them an essential tool for fleets prioritising safety.

Case Studies: Measured Cost Savings with Telematics

Telematics has helped UK fleets achieve clear cost savings, directly addressing accident-related expenses and operational hurdles.

Case Study 1: Fewer Accidents, Lower Costs

Royal Mail, with its massive fleet of 46,000 vehicles, showcases how even small improvements can lead to big results. Between 2017 and 2019, Mark Bromhall, their Road Safety Manager, launched the "Prevention First" strategy. This initiative introduced telematics to two-thirds of their vans and all HGVs, alongside manager-led investigations into every road traffic collision.

In 2019 alone, Royal Mail reported a 9.1% drop in collisions, which meant 750 fewer accidents and £1.5 million saved in claims costs. Over three years, this translated to about 2,500 fewer collisions.

"Last year, we reduced by 9.1%, equivalent to 750 fewer accidents... saving us £1.5 million in claims costs last year alone, not to mention the cost of repairs and time off work."

– Mark Bromhall, Road Safety Manager, Royal Mail

Case Study 2: Better Claims Management

In 2018, Johnsons Workwear, the UK’s largest textile provider, teamed up with VUEgroup and insurer Aviva to install video telematics across their 370-vehicle fleet. This system included forward, reversing, and driver-facing cameras, enabling precise incident documentation.

By mid-2020, Johnsons Workwear saw a 65% drop in at-fault incidents compared to mid-2018, despite maintaining a steady fleet mileage of 4.5 million miles. Reversing accidents alone decreased by 64%, and in Q1 2020, the fleet reported just 18 incidents, down from 49 incidents in Q1 2018 – a 63% reduction.

"Looking at the first half of 2020 and the previous two years, you can see a steady decline in reported accidents. This year, our incident numbers are down 49% compared to last year and are down 65% compared to the year before."

– Ian Greatrex, National Logistics Manager, Johnsons Workwear

The use of video evidence also revolutionised their claims process, eliminating uncertainties that often lead to 50:50 liability decisions.

These examples highlight how telematics can deliver both cost savings and improved safety. At GRS Fleet Telematics, we aim to provide advanced solutions that help UK businesses achieve similar results. These success stories set the stage for additional cost-saving strategies covered in the next section.

Other Ways Telematics Reduces Fleet Costs

Telematics doesn't just help with accident prevention - it also delivers savings across various aspects of fleet management. These savings grow over time, making telematics an increasingly smart investment for UK businesses managing vehicle fleets.

Fuel Efficiency and Reduced Maintenance Costs

Fuel is a massive expense for fleets, accounting for around 25% of operating costs for small to medium vans and up to 50% for heavy trucks and buses. A fleet of 20 vehicles covering 50,000 miles annually might spend £280,000 on fuel. Cutting fuel consumption by even 10% could save £28,000 each year.

Telematics plays a key role here by tracking driving behaviours that waste fuel, like harsh braking, rapid acceleration, speeding, and idling. For example, G4S used real-time feedback systems to cut idle time by 43%, reducing CO₂ emissions by two tonnes annually. Similarly, Nottingham City Council improved fleet efficiency by providing drivers with direct feedback through telematics across their depots.

The benefits extend beyond fuel savings. Harsh driving habits also lead to higher maintenance costs. By reducing aggressive behaviours like rapid acceleration or hard braking, fleets can lower maintenance expenses by up to 20%. Real-time diagnostics and predictive maintenance further help by cutting unplanned breakdowns by 24% and saving up to £5 for every £1 invested in repairs and downtime. These combined savings highlight the value of using telematics-driven insights to improve driver behaviour and fleet operations.

Enhanced Driver Training Programmes

Telematics also revolutionises how driver training is delivered. Instead of generic courses, telematics data allows for targeted training tailored to individual drivers' needs. Drivers with poor habits, like excessive fuel consumption or risky behaviours, can receive specific "Green Driver Training" to address these issues.

Fleet managers can even use league tables to rank drivers based on safety and efficiency metrics. Adding a gamified element, such as rewards for top performers, encourages positive habits and boosts motivation. Over time, managers can monitor progress and adjust training strategies, ensuring continuous improvement.

Theft Recovery and Vehicle Security

Telematics provides constant vehicle tracking, offering real-time location updates to fleet managers. This ensures unauthorised use during off-hours is quickly detected.

In cases of theft, GPS tracking enables rapid recovery. Advanced systems, such as dual-tracker technology that combines GPS with secondary tracking frequencies, prevent thieves from disabling the system with signal jammers. For instance, GRS Fleet Telematics reports a 91% recovery rate for stolen vehicles using dual-tracker solutions, helping businesses minimise losses and reduce operational disruptions.

The presence of tracking technology also acts as a deterrent, discouraging theft altogether. This added security doesn’t just protect assets - it can also lead to lower insurance premiums, as insurers value the data-driven risk management that telematics provides.

"In the event of a theft, the system enables swift location tracking to support recovery of the vehicle or asset, helping to minimise losses and reduce disruption to your business."

– Radius

How to Implement Telematics for Your Fleet

Choosing the Right Telematics Solution

Start by identifying what your fleet needs most. A system capable of collecting detailed data is essential - look for one that monitors metrics like speeding, harsh braking, and idling. Some of the latest systems also include AI-enabled dashcams that can detect driver distractions, tailgating, and seatbelt use. These features aren't just for show; they can help reduce accidents by up to 20%.

Another key feature to consider is claims management. A good telematics system should support First Notification of Loss (FNOL) and provide video evidence to challenge fraudulent or disputed claims.

For example, GRS Fleet Telematics offers three hardware packages:

- Essential (£35): Provides real-time tracking.

- Enhanced (£79): Adds dual-tracker theft protection.

- Ultimate (£99): Includes vehicle immobilisation.

Their software subscription costs £7.99 per vehicle per month. This fee covers SIM/data, an account manager, and full platform access. These solutions are designed to integrate smoothly into your operations while boosting safety and cutting costs.

Integrating Telematics with Fleet Insurance

Once you've got a system in place, sharing its data with your insurer can make a big difference. Insurers value fleets that demonstrate good management, and telematics data can help you make a strong case. In fact, 47% of companies in a survey of 500 firms said telematics helped them reduce their insurance premiums.

Prove you're serious about risk management by using tools like driver scorecards. These let you rank driver performance and offer targeted training to address risky behaviours, which can help secure better insurance terms. As Stewart Osmond, Haulage & Logistics Sales Leader at WTW, puts it:

"A proactive, data-led approach to fleet risk management is key to unlocking insurer capacity".

Don't wait until renewal time to share your progress with your insurer. Mid-term reviews are a great opportunity to present data showing reduced claims and improved driver behaviour - evidence that insurers are increasingly looking for.

Monitoring Performance and Measuring ROI

Once your telematics system is up and running, tracking its impact is vital. Start by setting clear data policies and focusing on key metrics like fuel usage, CO₂ emissions, and insurance claims frequency.

Driver scorecards can automate performance tracking and highlight areas for improvement. For instance, 58% of businesses reported fewer speeding fines after implementing telematics. Adding a gamification element - such as leaderboards or incentives for the safest drivers - can further encourage positive behaviour.

Other tools like geofencing can flag unauthorised vehicle use, while idling reports help pinpoint inefficiencies. Pairing telematics data with AI-enabled dashcams adds another layer of insight, offering visual evidence for events like harsh braking and simplifying claims processes. Regularly monitoring performance not only reinforces safety improvements but also strengthens your case for lower insurance premiums.

Conclusion

Fleet accidents can result in hefty direct and indirect expenses, creating significant challenges for businesses. Telematics provides a practical solution to minimise these costs while enhancing safety across your fleet. By turning safety insights into actionable savings, telematics has been shown to reduce collisions and speeding incidents. This directly translates to lower insurance premiums, fewer repair costs, and reduced downtime.

The real power of telematics lies in its ability to shift fleet management from reactive to proactive. Instead of dealing with accidents after they happen, telematics helps identify risky behaviours - like harsh braking or speeding - before they escalate into serious incidents. This proactive approach not only safeguards drivers but also strengthens your standing with insurers, who are increasingly offering better rates and terms to fleets with strong safety records.

GRS Fleet Telematics makes this proactive approach achievable, offering features like real-time tracking, driver monitoring, and theft recovery, with an impressive 91% recovery rate.

Beyond accident prevention, telematics also boosts operational efficiency. It reduces vehicle wear and tear, curbs downtime, and extends the lifespan of your fleet. In fact, 55% of companies report less wear and tear, while 48% experience reduced downtime. These benefits ensure vehicles remain operational and revenue-generating for longer.

Incorporating telematics not only cuts accident-related costs but also enhances safety and gives you a competitive edge in today’s data-driven insurance landscape. Whether your fleet consists of five vehicles or fifty, adopting telematics sets your business up for long-term savings, improved safety, and greater efficiency.

FAQs

How can telematics help lower the costs of fleet accidents?

Telematics offers a practical way to cut down on fleet accident costs by encouraging safer driving habits. With real-time monitoring and alerts for behaviours such as speeding or harsh braking, businesses can spot risky patterns early and take action to address them. This approach not only helps reduce the chances of accidents but can also lead to savings on insurance premiums and repair bills.

Another advantage is the ability to use telematics data for tailored driver training. By focusing on specific areas for improvement, drivers can sharpen their skills and adopt safer practices on the road. The result? Fewer accidents and lower related costs, making telematics a smart choice for boosting both financial efficiency and operational safety in fleet management.

What should I look for in a telematics system to enhance fleet safety?

To enhance fleet safety, opt for a telematics system that includes real-time GPS tracking, driver behaviour monitoring, and automatic alerts for actions like speeding or harsh braking. These tools make it easier to spot risky driving patterns and take swift action to promote safer habits.

Some advanced systems go a step further by offering onboard cameras to capture incidents, which can be crucial for analysing accidents and understanding what happened. Additionally, integrating data on fuel usage and vehicle maintenance can help avoid breakdowns and unsafe conditions. A system that's easy to use and provides clear reports can foster a safety-first mindset, cut down on accident-related expenses, and encourage better driving overall.

Can telematics help lower insurance costs for fleet vehicles?

Telematics can be a game-changer when it comes to cutting insurance costs for fleet vehicles. By offering detailed insights into driver behaviour, vehicle usage, and safety practices, telematics allows businesses to showcase lower risk profiles to insurers. Insurers tend to reward safer driving and effective risk management with reduced premiums, making this technology a valuable tool.

Beyond just cost savings, telematics also plays a role in accident prevention. It flags risky driving habits, giving businesses the chance to address these issues before they lead to incidents. Over time, this not only reduces the likelihood of accidents but also strengthens the case for negotiating better insurance terms.