Public-Private Models for Last-Mile Drone Delivery

Analysis of four public–private models for UK last‑mile drone delivery — healthcare, retail, regulatory and city‑led approaches, with costs, scalability and public concerns.

Last-mile delivery is expensive, making up over 50% of shipping costs. Public-Private Partnerships (PPPs) are emerging as a solution, combining government regulation with private sector technology to advance drone delivery systems. The UK market for drone delivery could be worth £10 billion, but scaling these models requires addressing infrastructure, regulations, and public concerns. Here's a quick look at four main approaches:

- Zipline (Healthcare): Focuses on medical deliveries, cutting delivery times by 90%, but faces high costs and weather challenges.

- Wing (Retail): Uses retail locations for quick, small-parcel deliveries. Scales easily but struggles with public acceptance.

- Amazon Prime Air (Regulatory): Works with regulators to shape drone laws but faces delays and high upfront investments.

- Government-Backed Models: Targets public services like NHS supply chains but needs better infrastructure and public trust.

Drone delivery is promising but requires collaboration across sectors, public engagement, and integration with existing logistics systems. By 2030, drones could add £45 billion to the UK economy if these challenges are addressed.

Zipline: The World’s Largest Drone Company You’ve Never Heard Of Just Raised $600M+

1. Zipline's Healthcare-Focused PPP Model

Zipline operates a centralised stock model designed to deliver emergency medical supplies efficiently. The company has achieved over 335,000 deliveries and flown more than 100 million miles worldwide. In these partnerships, governments incorporate Zipline's drone services into their healthcare supply chains, while Zipline provides the necessary technology, infrastructure, and fulfilment systems. This approach has been particularly useful in regions with inadequate road networks, cutting delivery times by as much as 90%. Let’s take a closer look at how this model performs in practice.

Effectiveness

Zipline’s operational framework has demonstrated a strong capacity for rapid response. The company’s FAA Part 135 certification allows for a service radius of 26 miles (42 km), ensuring quick delivery of essential medical items. Additionally, the service significantly reduces carbon emissions - by over 96% compared to traditional petrol-powered vehicles. In Ghana, this model has enabled the distribution of medical supplies to 90% of the population.

"Making sure our providers have what they need, when they need it, is a critical part of providing affordable and accessible care to patients."

- Florence Chang, President of MultiCare

However, the model’s success is tied to site suitability. Both distribution hubs and receiving locations must have designated landing or drop-off areas. Challenges such as adverse weather - high winds, rain, or snow - can disrupt operations. Additionally, there’s limited understanding of how the noise from drones might affect patients in hospital environments.

Scalability

While the model has proven operationally effective, scaling it presents unique hurdles. In Rwanda, government funding and philanthropic contributions helped offset costs, raising concerns about its long-term financial feasibility.

"UAVs are cost-intensive... and cannot be operated profitably in the medium term."

- SwissPost's assessment

Research suggests that for drone operations to sustain themselves financially without external support, costs would need to drop to roughly 19% of their current levels.

To address these challenges, Zipline has branched out beyond healthcare, venturing into sectors like restaurant food and grocery delivery to improve economic viability. The company has also expanded its operations from rural African settings into urban areas in the US, including Tacoma, Washington, and Dallas-Fort Worth, Texas. However, operating in densely populated urban areas introduces new obstacles, particularly around regulatory compliance for Beyond Visual Line of Sight (BVLOS) flights in crowded airspaces.

Costs

Although drone deliveries are much faster, they come with significantly higher operational expenses. Studies have shown that drone delivery costs are 133% higher than traditional van-based logistics. As Nature journal noted:

"It is understood that the costs of running the system are substantial and these have been borne by the government using philanthropic donations, raising long-term sustainability concerns."

In the UK, van-based medical deliveries remain far more economical, often benchmarked against tax-free mileage rates of £0.45 per mile (£0.72 per kilometre). Consequently, the financial advantages of drone delivery in healthcare settings tend to emerge only when the system is integrated into a larger network, handling diverse types of medical deliveries across multiple hospitals.

2. Wing's Retail Infrastructure PPP Model

Wing has embraced a "store-to-door" delivery system by joining forces with major retailers like Walmart. Rather than building standalone drone hubs, the company uses existing retail car parks and rooftops as launch sites for its drones. This setup allows orders to be delivered in under 10 minutes. So far, Wing has completed over 750,000 residential deliveries across three continents, with the fastest delivery clocking in at just 2 minutes and 47 seconds. By repurposing existing retail spaces, Wing has created a delivery model that not only speeds things up but also fits neatly into urban logistics systems.

Effectiveness

This retail-based model works particularly well for delivering time-sensitive items like perishable goods and over-the-counter medicines. It’s especially useful when road traffic slows down traditional delivery options. For example, Wing’s December 2025 launch in Metro Atlanta, planned to coincide with the holiday season, showcased its ability to handle peak demand in busy suburban areas. By taking small-parcel deliveries into the skies, Wing reduces road traffic, aligning with smart city initiatives.

"With delivery at an all-time high, Wing drones take cars off the road, easing congestion and reducing environmental impact."

- Wing Aviation

However, the success of this model depends heavily on advanced Unmanned Traffic Management (UTM) systems to ensure safety in crowded airspaces. Wing also supports regulations like the FAA’s proposed Part 108, which are crucial for enabling large-scale Beyond Visual Line of Sight (BVLOS) operations.

Scalability

One of the biggest strengths of Wing’s model is its ability to scale quickly by tapping into the vast network of existing retail locations. Its 2026 expansions into Greater Houston and Metro Atlanta highlight how seamlessly the service can grow when paired with established retail infrastructure. However, the UK has been slower to adopt this model compared to the US and Ireland, due to challenges like stricter airspace regulations and infrastructure readiness.

Scaling isn’t without its hurdles. Warehouses and retail centres need modifications such as charging stations, roof hatches, or landing pads to handle large volumes of drone deliveries. Public acceptance also plays a role. While only 26% of residents supported drone delivery in 2019, approval tends to rise significantly once people experience the service’s benefits firsthand. These factors directly impact the economic viability of the model.

Costs

Drone delivery offers a major cost edge over traditional methods. A single drone delivery costs about £0.92 per trip - much lower than the £3.97 to over 6 EUR spent on road-based deliveries. To achieve profitability, utilisation rates need to exceed 55%. This threshold was reached by Manna in early 2024 in Blanchardstown, Ireland, where the service covered 42,000 households and approximately 150,000 people.

On the public side, governments and local bodies bear their own costs, such as investing in UTM infrastructure and developing regulatory frameworks for "Droneports" in both urban and rural areas. This cost-sharing approach between public and private sectors helps spread financial responsibilities while speeding up the rollout of drone delivery systems.

3. Amazon Prime Air's Regulatory-Driven PPP Model

Amazon Prime Air has opted for a distinctive strategy by collaborating directly with national regulators to shape the legal framework for drone delivery. Rather than simply working within existing regulations, the company actively engages with authorities to enable Beyond Visual Line of Sight (BVLOS) operations. In 2024, Amazon rejoined the UK Civil Aviation Authority (CAA) trials, having previously paused operations in less regulation-friendly environments. Its 2016 Cambridge trial highlighted the need for more advanced operational frameworks to support drone delivery.

Effectiveness

This regulatory-driven approach allows Amazon to play a role in shaping the rules for drone delivery, particularly in areas like Unmanned Traffic Management (UTM) systems. In late 2024, the UK CAA introduced a SORA-style (Specific Operations Risk Assessment) approval framework, marking a key milestone for enabling routine commercial operations. By January 2026, Amazon began drone flights from its Darlington fulfilment centre, using the MK30 drone, which features advanced detect-and-avoid technology designed to handle urban obstacles. The service is expected to deliver packages weighing up to five pounds in under two hours for eligible Prime customers by the end of 2026.

"Starting flights in Darlington marks an important milestone in bringing drone delivery to the UK. Safety is our top priority and we have worked closely with Darlington Council and the Civil Aviation Authority."

- David Carbon, VP of Prime Air, Amazon

Despite these advances, public acceptance remains lukewarm. While support for drone delivery in the UK rose from 26% in 2019 to 61% in 2023, it is still one of the least supported applications of drone technology. Additionally, technical and financial challenges persist, with studies showing that drone operations are significantly more expensive than traditional delivery methods.

Amazon’s influence in regulatory development provides a foundation for exploring how drone systems can be scaled across the country.

Scalability

Amazon’s model prioritises regulatory progress over operational efficiency, making it heavily reliant on advancements in legal and technological frameworks. The UK government’s plan to implement UTM systems by 2026 is crucial for managing increased air traffic and scaling BVLOS operations. The potential market for last-mile delivery drones in the UK is estimated at around £10 billion. By 2030, drone delivery could add up to £45 billion to the UK economy and generate 650,000 jobs.

However, the UK has been slower to adopt drone delivery at scale compared to countries like Ireland and the USA, partly due to a more cautious regulatory stance. While Amazon’s approach may take longer to achieve widespread commercialisation, it aims to build the infrastructure needed for routine operations across large areas, rather than focusing on isolated, high-traffic regions.

Costs

The regulatory-driven model also comes with significant upfront costs. Amazon must invest heavily in research and development, regulatory compliance, and extensive trials. Unlike competitors such as Manna, which achieved "positive unit economics" in 2024 by concentrating on high-demand areas in Ireland, Amazon’s strategy focuses on long-term regulatory alignment rather than immediate profitability. The lack of standardised UTM infrastructure until at least 2026 forces private companies to develop their own safety technologies. However, full-scale adoption of commercial drone delivery could eventually lead to £22 billion in net cost savings across the UK economy. Amazon is betting on these long-term savings, even if it means delaying profitability in the short term.

4. Government-Backed Smart City PPP Models

In the UK, government-backed public-private partnerships (PPPs) are being used in several cities to advance drone delivery systems. These initiatives aim to identify practical applications that benefit society while creating the infrastructure needed for routine drone operations. A notable example is the "Flying High" challenge, launched in July 2018 by Nesta's Challenge Works in collaboration with five cities: London, West Midlands, Southampton, Preston, and Bradford. This project explored urban drone applications, such as transporting medical supplies between NHS hospitals in London and responding to traffic incidents in the West Midlands.

Effectiveness

As with earlier PPP initiatives, the success of these models hinges on aligning public needs with private sector strengths. Government-backed approaches are particularly effective at addressing city-specific challenges by leveraging private expertise. The "Flying High" project highlighted the demand for drone technology but also revealed substantial regulatory hurdles. For example, operating drones Beyond Visual Line of Sight (BVLOS) and integrating them into air traffic management systems remain significant challenges. Overcoming these barriers is essential for scaling drone operations.

To address infrastructure gaps, the Connected Places Catapult introduced its Droneport Design and Development Framework in March 2022. This document, spearheaded by Executive Director Henry Tse, offers guidelines for local authorities and investors on building commercially viable drone infrastructure.

"In order to enable commercially viable drone delivery services in our towns, cities and rural areas, Connected Places Catapult... has produced a Droneport Design and Development Framework. A first-of-kind Guidance Document for designers, engineers, investors, local authorities, and all stakeholders."

- Henry Tse, Executive Director – New Mobility Technologies

While these partnerships are strong in public service applications with local backing, their progress is limited by the UK's cautious regulatory environment. In contrast, countries with more permissive regulations have seen faster advancements. For example, Manna's drone delivery service in Blanchardstown, Ireland, achieved profitability by early 2024, serving 150,000 residents across 42,000 households with an average delivery time of just three minutes.

Scalability

Scaling government-backed models involves a step-by-step approach. The UK government has set a goal to enable routine BVLOS operations by 2027, with passenger and cargo transport via electric vertical take-off and landing (eVTOL) vehicles planned for 2028. By 2030, the drone sector is expected to contribute up to £45 billion to the UK economy, with projections of over 900,000 drones in operation.

A glimpse of scalability was seen in November 2025, when a partnership between BT, uAvionix, Skyfarer, and Intelligent Energy successfully conducted a BVLOS flight in Wales. Using a 25kg hexacopter powered by a hydrogen fuel cell, the flight demonstrated seamless handovers between C-Band, cellular, and satellite datalinks, managed by the uAvionix SkyLine Command and Control system. This achievement met Civil Aviation Authority safety standards.

"This demonstration showcases the reliability of multi-datalink C2 in real-world UK conditions, paving the way for expanded BVLOS applications."

- Dave Pankhurst, Innovation Director, Future Connected Solutions, BT

The Future of Flight Industry Group has also committed to a national action plan, backed by £125 million in government and industry investment. This initiative aims to align regulatory frameworks with industrial capabilities, fostering a robust drone ecosystem by 2030. However, despite these efforts, scaling remains a complex task.

Challenges

Government-backed models face several obstacles. One major issue is public scepticism - 61% of UK survey respondents oppose drone delivery, citing concerns about noise, privacy, and safety. Additionally, developing the necessary infrastructure, such as vertiports, charging stations, and modified warehouses, presents logistical challenges.

Economic feasibility is another hurdle. While the cost per delivery for a drone is around £0.92 compared to £3.97 for an electric van, integrating drones into multi-modal fleets can increase costs by up to 133%.

A shortage of skilled professionals in areas like drone manufacturing, unmanned aviation engineering, and AI further complicates scaling efforts. Moreover, the lack of fully integrated Unmanned Traffic Management (UTM) systems - expected to be operational by 2026 - forces cities and private partners to rely on temporary solutions, delaying the transition from trials to regular operations.

Advantages and Disadvantages

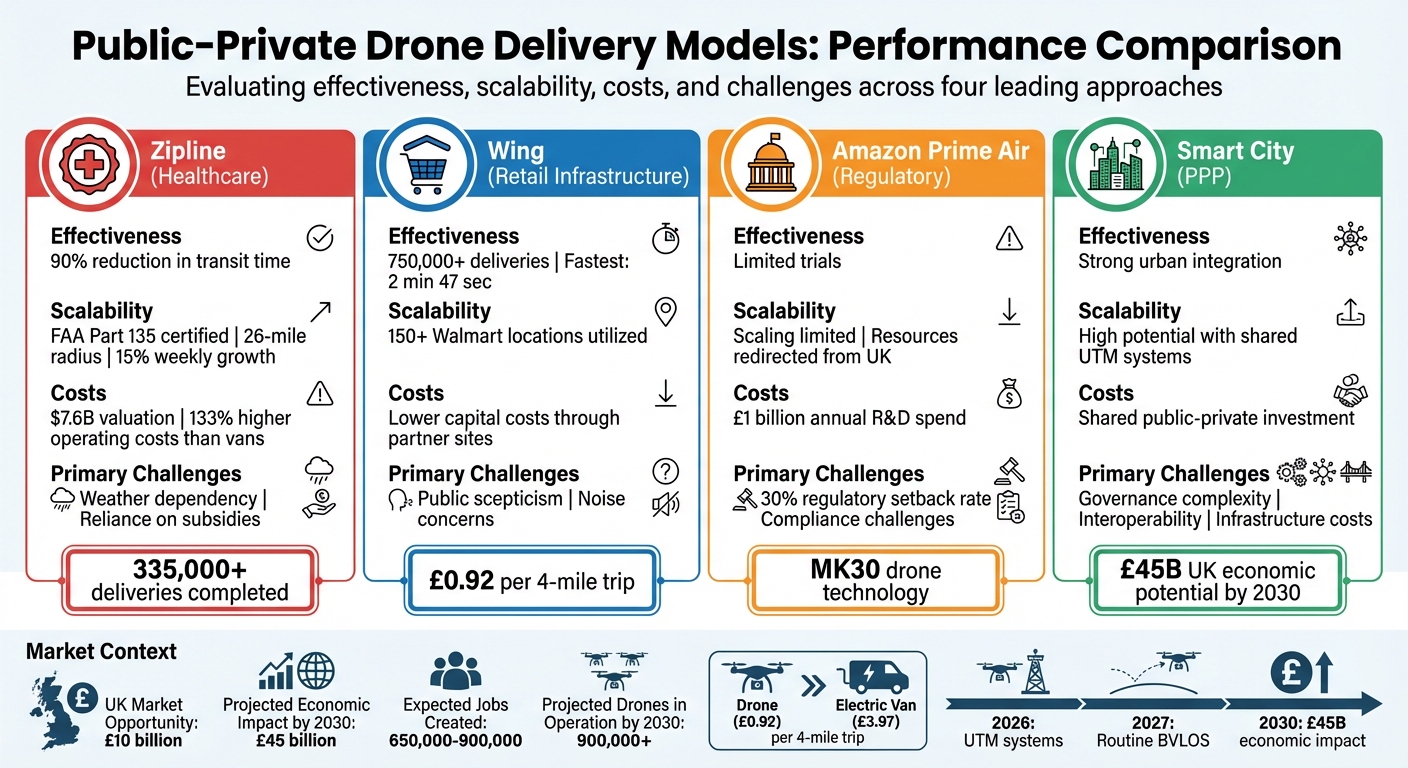

Comparison of Four Public-Private Drone Delivery Models: Effectiveness, Scalability, and Costs

Public–private models for last-mile drone delivery weigh factors like speed, cost, scalability, and regulatory challenges. Here's how different approaches stack up, highlighting their strengths and limitations.

Zipline's healthcare model shines in urgent, life-saving deliveries, slashing transit times by up to 90%. After securing $600 million in funding in January 2026, Zipline's valuation hit $7.6 billion. However, the model comes with a hefty price tag - operating costs are around 133% higher than traditional van-based delivery. It often depends on government or philanthropic funding to stay operational.

Wing's retail infrastructure model capitalises on existing retail locations, reducing upfront costs and enabling rapid scaling. By early 2026, Wing had completed 750,000 deliveries using this strategy. While this approach lowers capital expenditure by using partner sites instead of building new infrastructure, public scepticism remains a hurdle. That said, acceptance tends to grow with direct exposure.

Amazon Prime Air's regulatory-driven model invests heavily in research and development, with £1 billion spent annually. However, scaling remains a challenge due to strict regulatory environments. In the UK, about 30% of drone delivery applications face regulatory delays, slowing commercial progress.

Government-backed smart city models prioritise long-term integration into urban infrastructure, focusing on public benefits like safety, noise reduction, and privacy. These initiatives often involve developing Unmanned Traffic Management (UTM) systems. However, they require intricate governance frameworks to align the interests of regulators, city authorities, and private companies. By 2030, the UK drone sector could contribute £45 billion to the economy, provided it overcomes interoperability and infrastructure hurdles.

| Model | Effectiveness | Scalability | Costs | Primary Challenges |

|---|---|---|---|---|

| Zipline (Healthcare) | 90% reduction in transit time | FAA Part 135 certification allows a 26-mile radius; 15% weekly growth | Strong investor backing ($7.6B valuation); 133% higher operating costs than vans | Weather dependency; reliance on subsidies |

| Wing (Retail Infrastructure) | 750,000+ deliveries completed; fastest delivery in 2 minutes 47 seconds | Utilises 150+ Walmart locations | Lower capital costs through partner sites | Public scepticism; noise concerns |

| Amazon Prime Air | Limited trials | Scaling limited; resources redirected from UK market | £1 billion annual R&D spend | 30% regulatory setback rate; compliance challenges |

| Smart City (PPP) | Strong urban integration | High potential with shared UTM systems | Shared public-private investment | Governance complexity; interoperability issues; infrastructure costs |

These pros and cons set the stage for further exploration of the UK's drone delivery potential and the integration of fleet telematics systems.

UK Applications and Fleet Telematics Integration

The drone delivery market in the UK is projected to reach a £10 billion total addressable market. However, achieving this milestone hinges on integrating drones with existing ground-based logistics systems. Instead of replacing traditional delivery vans, drones act as a key addition to ground fleets, providing faster and more environmentally friendly solutions for urgent, single-item deliveries. The real challenge is ensuring these two systems work seamlessly within the UK's dense urban environments, which is the foundation of the hybrid logistics strategy outlined here.

Hybrid logistics models leverage the strengths of both drones and traditional vehicles. While Light Goods Vehicles (LGVs) can manage bulk deliveries efficiently, averaging about 20.5 parcels per hour, drones excel in bypassing traffic to complete urgent deliveries at a rate of 8 parcels per hour. The cost comparison is striking: drones cost around £0.92 per four-mile trip, whereas an electric van averages £3.97 for the same distance. By integrating fleet telematics systems - like GRS Fleet Telematics (£7.99 per vehicle monthly) - with Unmanned Traffic Management (UTM) systems, logistics managers can track both ground and aerial assets in real time. This synchronisation allows urgent or high-value deliveries to be routed via drones while vans handle bulk shipments, creating a balanced and efficient last-mile delivery network.

From 1 January 2026, drones will need to broadcast identification and location data, aligning with the real-time tracking standards already in place for ground fleets. Platforms like SORA and DSCO are expected to simplify the approval process for navigating complex urban routes.

For seamless operations, UK warehouses will need to adapt by including roof hatches, charging points, and landing pads to facilitate handoffs between vans and drones. Ashley Smart, EMEA Logistics Development Director at JLL, emphasised the urgency of this transition:

"Buildings must soon accommodate drones as technical and regulatory progress accelerates."

Additionally, the Connected Places Catapult released the Droneport Design and Development Framework in March 2022, offering practical guidance for local authorities and developers on incorporating drone-ready infrastructure.

Public perception is another important piece of the puzzle. Exposure to drone operations tends to improve acceptance, and with about 85% of the UK population living in detached or semi-detached houses, finding suitable landing sites is relatively straightforward. Routing flight paths along rivers, highways, and railways can also help minimise noise concerns. Winning public support is crucial to fully realise the benefits of hybrid logistics. If successful, the UK drone sector could add £45 billion to the economy by 2030, provided ground and aerial systems are effectively integrated.

Conclusion

Zipline's shift from healthcare to retail delivery highlights a model with impressive scalability, showcasing growth and operational success across various markets. Starting with essential medical services in Rwanda and Ghana, Zipline built trust and regulatory confidence before venturing into high-demand retail markets in the US. This approach underscores how public–private partnerships can foster regulatory support while achieving commercial viability. Similarly, Manna's operations in Ireland have proven that achieving positive unit economics is possible when utilisation rates exceed 55%, serving large populations efficiently with a well-structured delivery network.

The UK now faces the challenge of tailoring these successful models to its own regulatory framework. The Civil Aviation Authority (CAA) has set a goal for routine BVLOS (Beyond Visual Line of Sight) operations by 2027, providing a clear timeline for progress. Collaborative efforts between drone operators and local authorities have already shown promise, with Amazon Prime Air's partnership with Darlington Council and the CAA serving as a strong example of how regulatory cooperation can advance drone delivery while maintaining public trust.

Unlocking the UK's £10 billion drone delivery market will require tackling key issues, including infrastructure development, public acceptance, and Unmanned Traffic Management (UTM) systems. Local authorities must embed droneport infrastructure into urban planning, guided by frameworks like the Connected Places Catapult's 2022 recommendations. Public engagement is equally critical - current support for drone delivery stands at just 26%, highlighting the need for targeted efforts to build trust. Additionally, investment in UTM systems must accelerate to accommodate the anticipated 900,000 drones projected to operate in UK airspace by 2030.

The UK's path forward should combine Zipline's scalable approach, Manna's cost-effective operations, and Amazon's regulatory collaboration expertise. This hybrid model would position drones as a complementary tool to traditional delivery methods, creating a seamless logistics network. Incorporating advanced fleet telematics, such as those offered by GRS Fleet Telematics, could further unify aerial and ground operations, paving the way for efficient, scalable logistics. With an estimated £45 billion economic boost by 2030, the potential is immense. However, success will hinge on coordinated efforts across infrastructure, regulation, and public engagement.

FAQs

How do public-private partnerships support the growth of last-mile drone delivery?

Public-private partnerships (PPPs) are key to advancing last-mile drone delivery by merging the strengths of both sectors - resources, expertise, and infrastructure. These partnerships help push boundaries, improve efficiency, and tackle regulatory hurdles, paving the way for the rapid expansion of drone networks.

In the UK, efforts like the government’s "Future of Flight" action plan and industry-led projects, such as Beyond Visual Line of Sight (BVLOS) trials, highlight the importance of PPPs in creating a regulatory environment that supports cutting-edge drone operations. Through collaboration, public and private organisations can break down barriers, making drone delivery more practical and accessible for businesses and consumers.

What challenges exist in integrating drones into UK logistics networks?

Bringing drones into the UK's logistics networks isn't without its hurdles. The main challenges fall into three areas: regulatory, technical, and societal.

Regulatory Barriers

Strict aviation rules, particularly around Beyond Visual Line of Sight (BVLOS) operations, are a major sticking point. These regulations currently restrict the widespread use of drones. For BVLOS operations to become a regular feature, significant changes to these rules are needed. The UK Civil Aviation Authority is working on this, but progress is gradual.

Technical Challenges

Drones also face technical difficulties. Navigating busy urban areas, managing limited payload capacities, and connecting with existing delivery systems - like vans and bicycles - are no small tasks. On top of that, unpredictable weather and complex routing requirements make operations even trickier.

Societal Concerns

Public trust is another big piece of the puzzle. People have valid concerns about safety and privacy, and without addressing these, widespread acceptance of drone deliveries will be hard to achieve.

Tackling these challenges is key to building efficient last-mile delivery systems that can scale across the UK.

What impact does public opinion have on the adoption of drone delivery services?

Public opinion plays a crucial role in determining how widely drone delivery services are adopted. It influences not only consumer trust but also regulatory decisions and how communities respond to this new technology. In the UK, where regulations tend to be stricter compared to other regions, trust in drones for last-mile deliveries remains fairly limited. Common concerns include safety risks, privacy issues, and the potential for noise pollution.

These negative perceptions can slow down regulatory approvals and make it harder to gain community support, particularly in crowded urban areas. However, highlighting the potential advantages - like quicker delivery times and less traffic congestion - could help shift public attitudes. To build trust and make drone delivery viable on a larger scale in the UK, it's essential to address these concerns directly and showcase the technology's reliability.