Fleet Telematics and Risk Profiling Benefits

Real-time telematics builds accurate driver risk profiles, lowers premiums and speeds up claims with GPS, diagnostics and AI dashcams, but needs privacy safeguards.

Fleet telematics is reshaping how businesses manage vehicle risks and insurance costs. By using real-time data from GPS, diagnostics, and AI dashcams, insurers and fleet operators can assess driving behaviour, predict accidents, and reduce costs. Compared to older methods that rely on static data like driver age or postcode, telematics provides actionable insights instantly, helping prevent incidents before they occur.

Key Points:

- Real-time data tracks speed, braking, and road types to build accurate driver risk profiles.

- Lower costs: Businesses report up to 47% reduced premiums and fewer crashes (20–43%).

- Improved claims: Data like GPS and video footage simplifies accident disputes and reduces fraud.

- Usage-Based Insurance rewards safer drivers with tailored premiums.

- Challenges: Privacy concerns, data overload, and upfront costs require careful management.

Quick Takeaway: Telematics offers a smarter, data-driven way to manage fleet safety and insurance, making it a game-changer for businesses looking to cut costs and improve efficiency.

1. GRS Fleet Telematics

Risk Accuracy

GRS Fleet Telematics takes the guesswork out of risk assessment by using real-time data instead of generalised assumptions. Instead of relying on factors like postcode or driver age, the system analyses actual driving behaviour. It tracks speed compliance, harsh braking, sharp cornering, and acceleration patterns. GPS trackers and onboard diagnostics (OBD-II) continuously gather information on engine health, idle times, and trip durations, building tailored risk profiles for each driver and vehicle. This approach also factors in road types and time of day, offering a more accurate prediction of accident likelihood. With such detailed insights, proactive driver monitoring becomes a reality.

Driver Monitoring

Driver performance is evaluated through scorecards that categorise behaviour into safe, moderate, or high-risk levels, allowing fleet managers to act swiftly when needed. AI-powered dashcams further enhance safety by identifying risky behaviours like distraction or tailgating. To encourage safer driving, many fleets integrate gamification techniques, such as league tables and reward schemes, to motivate drivers. This real-time monitoring also ensures transparency in claims management.

Claims Management

When incidents occur, telematics provides robust, data-driven evidence to eliminate uncertainty. GPS and accelerometer data enable detailed collision reconstructions, offering clarity in disputes. For example, UK companies have used telematics data to challenge accident claims or contest speeding fines, with 58% reporting a reduction in fines paid. The system also enables First Notification of Loss (FNOL) within 24 hours, a critical step in cutting third-party capture costs and minimising overall claim expenses. Additionally, the digital evidence helps protect fleets from fraudulent claims and unwarranted penalties.

Insurance Outcomes

Proving low-risk driving habits through telematics data can lead to real financial advantages, including better pricing and more favourable insurance terms. Fleets that adopt this data-driven approach become more appealing to insurers, particularly in tighter markets. GRS Fleet Telematics offers affordable solutions starting at £7.99 per month, with dual-tracker technology achieving a 91% recovery rate for stolen vehicles. This combination of cost-effectiveness and reliable performance allows fleets to benefit from reduced excesses and improved policy conditions.

2. Traditional Fleet Risk Profiling

Risk Accuracy

Traditional fleet risk profiling leans heavily on static factors that don't reflect actual driving conditions. Insurers typically assess risk using criteria like age, marital status, credit scores, and vehicle type. While these proxies offer a baseline, they fail to account for real-world driving behaviours or patterns. This approach often results in delayed risk detection. Another issue is that drivers frequently underreport their annual mileage on insurance forms to secure lower premiums, further distorting the accuracy of these models. For instance, in a study of 100,000 simulated policies, the claim rate was about 4.27%. These systemic shortcomings ripple through all facets of risk management.

Driver Monitoring

Traditional methods for monitoring driver behaviour rely on anecdotal evidence and historical records. This means issues often only surface during annual insurance renewals, leaving little room for timely intervention. Alexander Dungate, Business Development Director at WTW, highlights the reactive nature of this system:

"Traditional fleet risk management is generally reactive. For example, there may have been an accident or series of events that highlight you need to address how a particular driver is behaving".

Historically, these models depended entirely on static data, offering no real-time insights.

Claims Management

The lack of real-time data in traditional systems complicates claims management. Delayed First Notification of Loss (FNOL) and the absence of objective evidence make it harder to determine liability. This delay not only increases third-party claim costs but also exposes fleets to fraudulent claims. Without timely evidence, disputes often escalate into drawn-out litigation, adding to costs. For example, insurance claims rise by 50% when video safety solutions are not in place. Additionally, around 80% of incidents are linked to distracted driving - behaviours that traditional systems are unable to detect or verify. These delays and gaps undermine the fairness and efficiency of insurance outcomes.

Insurance Outcomes

Unlike telematics-based models, traditional risk profiling offers no incentive for improved driving behaviour. Static premiums penalise safe drivers who belong to high-risk demographic groups, regardless of their actual performance on the road. Experts argue that using data-driven approaches can help insurers optimise their capacity. A real-world example comes from Benson Systems, which, in January 2026, reduced its insurance premiums by an estimated 15% to 20% by adopting an AI-powered telematics system. Dave Powell, the company's Quality Assurance and Safety Director, noted:

"technicians know they're being watched through AI... they are less likely to drive recklessly".

How Large Fleets Actually Use Telematics to Improve Driver Safety

Advantages and Disadvantages

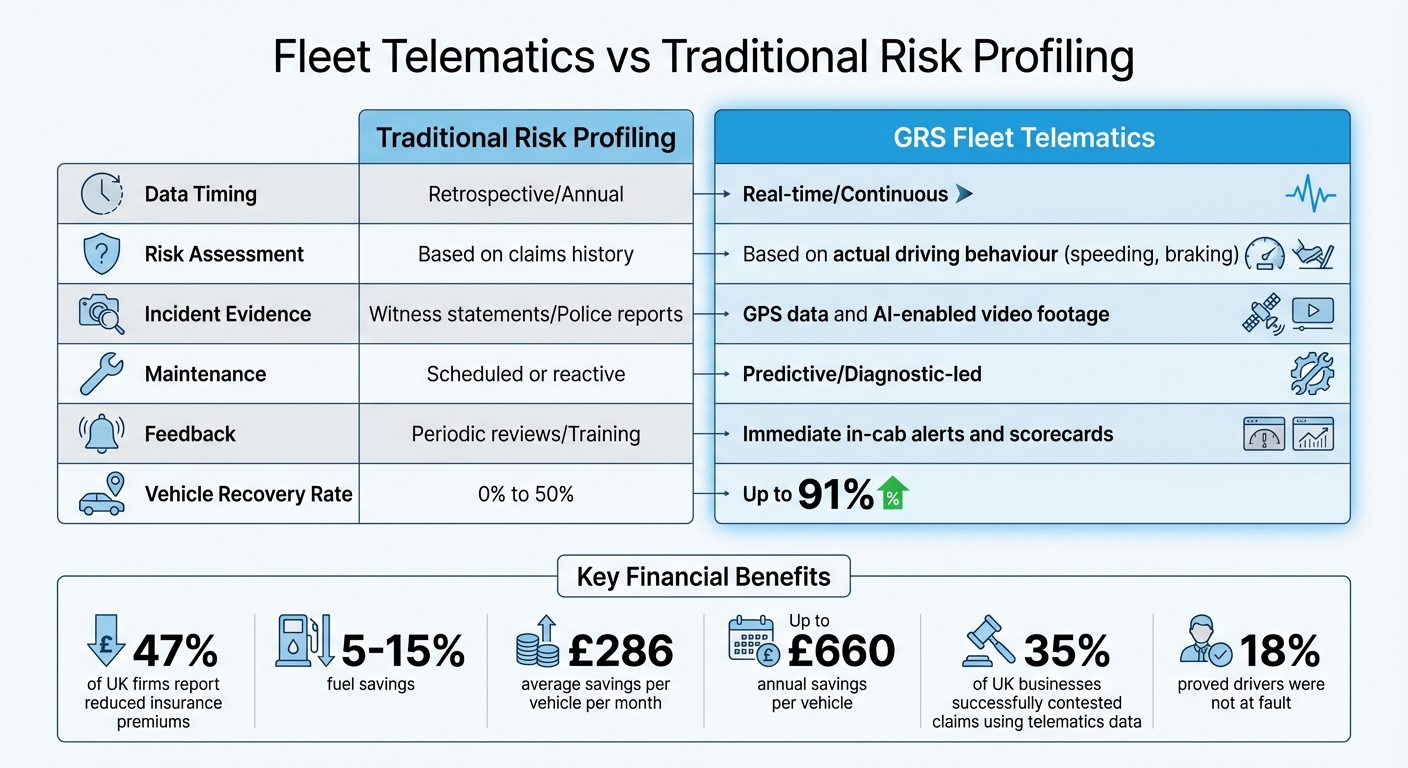

GRS Fleet Telematics vs Traditional Risk Profiling Comparison

Telematics-driven and traditional risk profiling take very different approaches, each with its own strengths and weaknesses. Traditional methods rely on historical data, often reviewed just before annual insurance renewals. In contrast, telematics provides real-time information that can be turned into actionable insights on the spot. This shift from reactive to proactive management is changing how fleets handle risk.

Here’s a side-by-side look at how the two methods compare:

| Feature | Traditional Risk Profiling | GRS Fleet Telematics |

|---|---|---|

| Data Timing | Retrospective/Annual | Real-time/Continuous |

| Risk Assessment | Based on claims history | Based on actual driving behaviour (e.g., speeding, braking) |

| Incident Evidence | Witness statements/Police reports | GPS data and AI-enabled video footage |

| Maintenance | Scheduled or reactive | Predictive/Diagnostic-led |

| Feedback | Periodic reviews/Training | Immediate in-cab alerts and scorecards |

| Vehicle Recovery Rate | 0% to 50% | Up to 91% |

The operational differences between the two methods are clear, but telematics also brings notable financial benefits. For instance, it can cut fleet costs by delivering fuel savings of 5%–15% and reducing insurance premiums for 47% of UK firms. Customers using GRS Fleet Telematics report saving an average of £286 per vehicle per month due to improved productivity and reduced fuel consumption. On top of that, annual savings can reach up to £660 through lower theft rates and fuel costs.

However, telematics isn’t without its challenges. Drivers often express concerns about privacy, making transparent internal policies essential to address these worries. Managers can also feel overwhelmed by the sheer volume of real-time data if they lack proper training in how to interpret it. For smaller operators, the upfront installation costs can be a financial strain. Additionally, telematics systems may occasionally penalise drivers for necessary defensive actions, such as hard braking to avoid accidents caused by others.

Even with these hurdles, telematics has proven its worth in other ways. In fact, 35% of UK businesses have used telematics data to contest accident claims or speeding fines, with 18% successfully proving that their drivers were not at fault.

Conclusion

Telematics has reshaped how fleet operators in the UK manage risk and insurance expenses. Instead of relying solely on demographic data or past claims, insurers now use real-time driving behaviour to assess risk more accurately. This shift allows fleets to proactively address risky habits - like harsh braking or speeding - before they escalate into accidents and costly claims.

The financial benefits are clear. Telematics helps fleets secure better premium rates, with nearly half of UK businesses reporting reduced insurance costs and 35% successfully challenging claims. For fleets facing annual repair costs of around £6,000 and losing five days to downtime, the savings can add up quickly.

GRS Fleet Telematics builds on these advantages, offering UK businesses an affordable system equipped with real-time monitoring and robust security features. With tools like GPS tracking and driver scorecards, fleets can take immediate action to improve safety, reduce risk, and negotiate better insurance terms - whether they’re small tradespeople or large logistics operators.

As repair costs rise and insurers tighten their underwriting criteria, telematics has become indispensable. By improving driver behaviour, strengthening claims defensibility, and boosting operational efficiency, this technology provides the behavioural insights insurers now require. It’s a practical, data-driven way to align risk management with cost savings, shaping the future of fleet insurance in the UK.

FAQs

How does fleet telematics help improve risk profiling for better insurance terms?

Fleet telematics transforms risk profiling by delivering real-time insights into driver behaviour, vehicle usage, and operational trends. Traditional methods often rely on historical claims data and generic vehicle information, but telematics goes a step further. It tracks specific metrics like speed, harsh braking, rapid acceleration, and route patterns. This level of detail allows insurers to evaluate risks with far greater accuracy and spot unsafe driving habits.

For fleet operators, telematics offers a hands-on way to enhance driver safety. By actively monitoring behaviour, they can encourage safer driving practices, which helps reduce the chances of accidents. This approach doesn't just improve safety - it can also lead to lower insurance premiums and customised policy terms that align with the fleet's actual risk profile. In essence, telematics provides a smarter, more dynamic method for managing risks and achieving better insurance outcomes.

What privacy concerns should businesses consider when using fleet telematics?

Fleet telematics brings undeniable benefits, but it also raises some valid privacy concerns. Sensitive data, like vehicle locations, driving patterns, and habits, is constantly being collected. Understandably, drivers and fleet operators worry about how this information is stored, who has access to it, and whether it could be misused or fall victim to security breaches.

Another major issue is the lack of transparency and control over personal data. Many drivers feel uneasy about the possibility of their data being used unfairly - whether for adjusting insurance rates or engaging in unnecessary monitoring. To ease these worries, companies need to prioritise trust. This means having clear, straightforward policies and implementing strong data protection measures to safeguard users' information. Addressing these concerns is key to increasing confidence and encouraging more widespread use of telematics systems.

How can businesses handle the initial costs of introducing telematics systems?

Businesses can handle the initial expense of telematics systems by focusing on the long-term savings and advantages they bring. Start by calculating the upfront costs and pinpointing areas where telematics can lower expenses - think reduced fuel usage, lower insurance premiums, and fewer inefficiencies in operations.

Telematics often yields measurable financial returns relatively quickly. For example, it can lead to better driver behaviour, fewer accidents, and higher vehicle recovery rates. By developing a detailed financial plan that highlights both the costs and the expected savings, businesses can allocate their budgets more effectively. This method ensures that the initial investment is offset by long-term benefits, making telematics a smart choice for managing fleets.