EV Charging Patterns: Geospatial Insights

Geospatial charging analysis exposes urban–rural gaps and guides fleet charging locations and timing to reduce costs, grid strain and emissions.

Where and when EV drivers charge matters more than you think. For UK fleet operators, understanding charging patterns is crucial for planning infrastructure, cutting costs, and meeting emission targets. Geospatial data - linking location-specific insights - helps identify optimal charging spots, avoid grid issues, and schedule charging during low-demand hours.

Key Points:

- Fleet Challenges: Vans made up 16% of UK transport CO₂ emissions in 2020. Electrifying fleets is essential for meeting the 2035 zero-emission mandate.

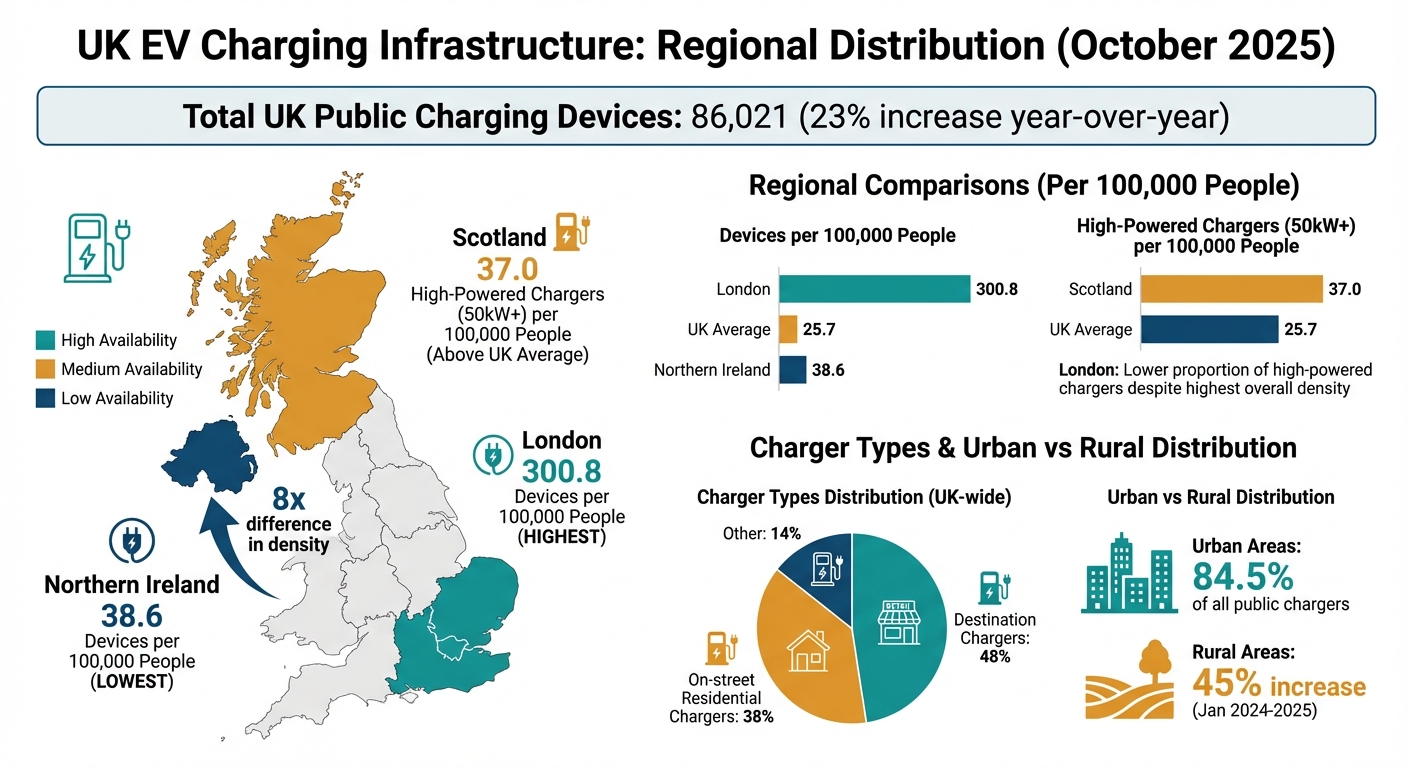

- Charging Gaps: By October 2025, the UK had 86,021 public chargers, but availability varies widely - London has 300.8 per 100,000 people, Northern Ireland only 38.6.

- Geospatial Tools: Platforms like ZERO and GRS Fleet Telematics analyse telematics, traffic, and grid data to optimise charging locations and schedules.

- Urban vs Rural Needs: Urban fleets rely on dense on-street chargers, while rural areas benefit from rapid chargers for long-distance travel.

Why It Matters:

Deploying chargers without considering demand or grid capacity wastes resources. Geospatial data helps fleet operators make smarter decisions, ensuring a smoother transition to electric vehicles while reducing operational risks and costs.

Finding EV Charging Cold Spots with TRACC: Data-Driven Insights for Smarter Infrastructure

UK Studies on EV Charging Patterns

UK EV Charging Infrastructure Distribution by Region 2025

Government Reports on Charging Infrastructure

Government data highlights a stark imbalance in the availability of public EV charging points across the UK. As of 1 October 2025, there were 86,021 public charging devices - a 23% increase compared to the previous year. Yet, this growth isn’t evenly distributed. London tops the list with an impressive 300.8 devices per 100,000 people, a figure almost eight times higher than Northern Ireland, which lags behind at just 38.6 per 100,000. Scotland stands out for its high-powered chargers (50kW or more), boasting 37.0 devices per 100,000, well above the UK average of 25.7.

The Geospatial Commission's Getting to the Point report stresses that the placement of chargers matters just as much as their quantity. Nearly half (48%) of all public chargers are "destination" chargers, typically found in locations like retail parks or leisure centres. Meanwhile, 38% are on-street residential chargers. In London, the emphasis is on slower on-street chargers (3kW to 8kW), which explains its lower proportion of high-powered chargers despite having a dense overall network. These disparities in charger types and locations highlight the need to explore the differences between urban and rural charging demands.

Charging Infrastructure in Urban and Rural Areas

For fleet operators, these regional differences call for customised charging solutions. Urban areas account for 84.5% of all public chargers, while rural regions saw a 45% increase in devices between January 2024 and January 2025, supporting long-distance travel. This urban–rural divide requires thoughtful planning to ensure efficient fleet operations across diverse environments.

Urban fleets often rely on high-density on-street chargers, especially for drivers without access to off-street parking. In contrast, rural areas benefit from rapid chargers strategically placed along major routes to support longer journeys. Addressing these distinct needs is crucial when determining depot locations and scheduling, ensuring vehicles can recharge effectively no matter where they are operating.

Spatial and Temporal Charging Patterns

Recent geospatial data has shed light on the distinct ways electric vehicle (EV) charging varies across locations and times.

Geographic Distribution of Charging Demand

Population density and parking availability play a big role in determining where EVs are charged. As of 1 January 2025, 84.6% of public charging devices in England were found in urban areas. City centres often rely on rapid chargers to support onward travel, while high-density residential neighbourhoods benefit from slower, overnight on-street chargers.

When it comes to high-power charging, the picture changes. Scotland leads with 29.0 high-power devices (50kW or above) per 100,000 people, compared to London’s 15.1 per 100,000, despite London boasting the highest overall charging provision at 250.4 devices per 100,000. This difference stems from London’s focus on slower on-street residential chargers, catering to households without private driveways or garages. For fleet operators, understanding these patterns is crucial for planning depot locations and investing in charging infrastructure that aligns with their operational needs. These spatial trends also set the stage for examining when and how frequently EVs are charged based on fleet models.

When and How Often EVs Are Charged

Charging habits differ greatly depending on fleet type and operational needs. Between July 2021 and June 2022, the Optimise Prime project studied over 8,000 commercial EVs across three charging scenarios: return-to-home charging (with demand peaking overnight), depot-based charging (optimised through smart load management), and mixed private hire operations.

In Oxfordshire, the County Council collaborated with Mind Foundry to use a machine learning platform that integrates live and historical data. This system monitors electricity capacity and forecasts future charging needs. By visualising demand, the council can better direct funding applications and ensure chargepoints are installed where they’ll see the most use. Fleet operators can leverage similar temporal analysis to plan charging during off-peak hours, cutting electricity costs while ensuring vehicles remain ready for operation.

Using Geospatial Data in Fleet Telematics

Fleet operators are increasingly using geospatial analysis alongside tracking systems to fine-tune EV charging strategies. By combining telematics with location-based data, businesses can better understand when and where their vehicles need to charge. This integration forms the backbone of the advanced tools provided by GRS Fleet Telematics.

Optimising Charging with GRS Fleet Telematics

GRS Fleet Telematics leverages geospatial data to help UK van fleets improve charging efficiency. Real-time tracking enables fleet managers to monitor vehicle locations and coordinate charging schedules based on depot availability and grid capacity. By studying route patterns and electricity network data from distribution network operators, businesses can pinpoint the best locations for charging infrastructure while avoiding strain on local grids. The system also provides alerts for entering or exiting charging zones, encouraging off-peak charging to save on electricity costs. Beyond charging, this data-driven approach enhances overall fleet operations and security.

Improving Fleet Security and Efficiency

Efficient charging is just one piece of the puzzle. GRS Fleet Telematics also strengthens fleet security through dual-tracker technology, which boasts a 91% recovery rate, and features like remote immobilisation. If a vehicle is stolen, operators can disable it remotely, and a secondary Bluetooth backup ensures tracking continues even if the main device is compromised. All of this is available for just £7.99 per vehicle each month.

Geospatial insights also help identify areas where off-street parking is limited, guiding solutions for home charging or directing drivers to nearby public chargepoints. Additionally, the platform's driver safety tools, including speed alerts and eco-driving analytics, not only improve safety but also reduce energy consumption, helping vehicles go further between charges.

Conclusion

For fleet operators in the UK, understanding spatial and temporal charging patterns isn't just a technical detail - it's a cornerstone for managing costs, cutting emissions, and maintaining a resilient operation. With vans contributing 16% of the UK’s transport CO₂ emissions in 2020 and the government projecting the need for at least 300,000 public chargepoints by 2030, the shift to electric fleets requires careful, data-driven planning. These insights pave the way for a systematic approach to fleet electrification.

Geospatial analysis is a game-changer in this transition. By combining telematics with location data, operators can identify the best routes, ideal charging locations, and potential grid constraints. This approach empowers operators to make smarter choices about which vehicles to electrify and where to invest in charging infrastructure, ensuring a seamless transition with minimal disruption.

Key Takeaways for Fleet Operators

- Leverage telematics and geospatial data: By integrating data on terrain, weather, and traffic patterns, operators can better predict energy demands and optimise vehicle performance.

- Assess depot charging feasibility: Before committing to depot charging infrastructure, check the electricity network’s capacity using Distribution Network Operator data. This step can help avoid unexpected upgrade costs.

- Support home-based drivers: For drivers who take vehicles home, geospatial analysis can identify those with off-street parking and those needing public or on-street charging solutions.

Smart charging strategies are another vital piece of the puzzle. By using temporal data, operators can lower electricity costs by scheduling charging during off-peak hours, reducing strain on local grids. Tools like GRS Fleet Telematics make this easier, offering real-time tracking and route analysis for just £7.99 per vehicle per month. Pairing charging optimisation with dual-tracker technology and a 91% recovery rate creates a well-rounded, efficient, and secure approach to managing electric fleets.

FAQs

How can geospatial data improve EV charging locations for fleet operators?

Geospatial data plays a key role in helping fleet operators determine the ideal spots for EV chargepoints. By analysing routes, depot locations, and customer destinations, it becomes possible to identify high-demand areas and address gaps in the current infrastructure. This ensures chargers are installed where they’re needed most, cutting down travel distances and improving overall operational efficiency.

With advanced data analysis techniques, it's even possible to forecast future charging needs and make informed decisions about site placement, all while keeping fleet operations running smoothly. For example, GRS Fleet Telematics offers detailed van-tracking data that supports these efforts. This data not only aids in cost-effective chargepoint roll-outs but also streamlines fleet management across the UK.

How do charging infrastructure needs differ between urban and rural areas?

Urban areas thrive on a dense network of fast-charging points conveniently located near homes, workplaces, and shopping centres. For drivers without off-street parking, public on-street and destination chargers become essential. Many prefer rapid chargers (50 kW or more), which can recharge a vehicle in under 30 minutes, keeping disruptions to their daily schedules to a minimum. For fleet operators, the abundance of charging points in cities allows for efficient overnight depot charging, with the flexibility to add quick top-ups at retail or work locations during the day.

In rural areas, the priorities change. Here, high-power chargers (150 kW or more) are strategically placed along major roads to support long-distance travel. Drivers in these regions typically expect a reliable charging point every 80–100 km and are often willing to make minor detours to access one. With fewer charging stations overall, rural infrastructure focuses on fast-charging hubs at service stations, motorway stops, and key town centres. Fleet managers in rural settings must plan routes carefully, using tools to optimise charging stops and reduce delays.

How can fleet managers use charging patterns to lower electricity costs?

Fleet managers can cut electricity expenses by carefully timing when their EVs are charged, taking advantage of off-peak hours when energy rates are lower. By analysing factors like vehicle routes, time spent at depots, and regular return-to-base schedules, operators can plan charging sessions to match cheaper tariff periods while keeping vehicles operationally ready.

Using real-time data from GRS Fleet Telematics, managers gain detailed insights into vehicle locations, battery levels, and the availability of charging points. This information enables automated scheduling of charging during cost-effective times, such as between 23:00 and 06:00, when electricity in the UK typically costs around £0.08 per kWh. Avoiding peak hours - usually 17:00 to 20:00 - where prices can exceed £0.30 per kWh, not only lowers expenses but also supports grid stability and ensures the charging infrastructure is used efficiently.