Best Practices for Fleet Parts Forecasting

Predict parts needs with telematics, maintenance histories and AI to reduce downtime, prevent emergency repairs and optimise inventory.

Fleet parts forecasting helps you plan maintenance and inventory by predicting parts replacements using historical data, real-time telematics, and external factors. This reduces downtime, prevents costly emergency repairs, and balances inventory levels. Rising maintenance costs and supply chain disruptions make forecasting more critical than ever.

Key takeaways:

- Data Sources: Combine real-time sensor data (e.g., engine hours, fault codes) with historical records and supplier lead times.

- Forecasting Methods: Use statistical models for stable demand and AI for complex, non-linear data.

- Implementation Steps: Audit maintenance logs, integrate telematics, and start with high-value components.

- Challenges: Solve data silos, manage inventory levels, and plan for supply chain delays.

- Metrics: Measure accuracy, stockout rates, unplanned maintenance, and emergency costs.

Predict Vehicle Failure and Auto Scheduling of Vehicle Preventive Maintenance in Garage/Depot.

Data Sources for Parts Forecasting

Effective parts forecasting relies on a mix of real-time data, historical information, and external factors. For instance, real-time sensor data - like engine temperature or brake pad wear - provides immediate insights. When combined with historical maintenance logs, which reveal failure patterns, and vehicle usage metrics (e.g., mileage, engine hours, fuel consumption), fleets can predict wear based on actual utilisation.

External factors are just as crucial. Supplier lead times dictate inventory needs; longer delivery times mean fleets must hold more safety stock to avoid running out before new shipments arrive. Seasonal weather patterns also influence demand - think of the need for winter tyres, which mechanical sensors alone can't predict. Additionally, diagnostic fault codes from engine control modules (ECM data) flag potential issues early, allowing for predictive replacements before failures occur.

Telematics Data and Real-Time Monitoring

Telematics has transformed how fleets monitor component conditions. Instead of relying on fixed maintenance intervals, systems like GRS Fleet Telematics track engine hours and odometer readings in real time. This enables usage-based maintenance, ensuring parts are replaced just-in-time rather than stockpiling unnecessarily.

Ignoring real-time data can be costly. For example, check engine lights often remain ignored for an average of 90 days, leading to wasted fuel and poorer performance. Similarly, underinflated tyres can reduce fuel efficiency by 2% for every 10 PSI below the recommended level, increasing tyre-related replacements. With trucking costs hitting £1.77 per mile in 2024 (a 0.8% rise from the previous year), using telematics to optimise parts forecasting becomes essential for controlling expenses. Even simple alerts, like battery voltage dropping below 9V, can help avoid unexpected replacements.

Historical Maintenance Records

Historical repair logs are a goldmine for spotting recurring issues across fleets. These records establish a baseline for AI and machine learning models, helping them identify patterns and predict failures more accurately. When paired with telematics, these logs can uncover links between specific sensor readings and future part failures, refining predictions over time.

The move towards centralised data systems has made it easier for fleets to combine information from multiple sources - telematics, daily inspections, and historical logs - into a single platform for analysis. This unified view provides insights that no single data source could offer on its own. Beyond internal data, external factors further enhance forecasting accuracy.

Supplier Lead Times and External Factors

External data, like supplier lead times and environmental conditions, plays a critical role in determining when to reorder parts. Lead times - the gap between ordering and receiving parts - directly affect inventory levels. Longer lead times mean fleets need higher reorder points to avoid running out of stock. External disruptions can also cause shortages, making safety stock essential to maintaining operations.

Seasonal needs, such as tyre changes in May and October, depend more on weather patterns than vehicle usage. For example, aerodynamic components, which help Class 8 trucks minimise fuel consumption (50% of which is spent overcoming air resistance), also require careful maintenance to manage lifecycle costs. Ross Jephson from Chevin Fleet Solutions highlights:

"Maintenance costs have been rising each year with the most recently reported increase of between 6-7% being attributed to labour and parts costs".

Integrating fleet management software with vendor inventory systems can provide real-time updates on parts availability, simplifying emergency orders and ensuring smoother operations.

Forecasting Methods and Tools

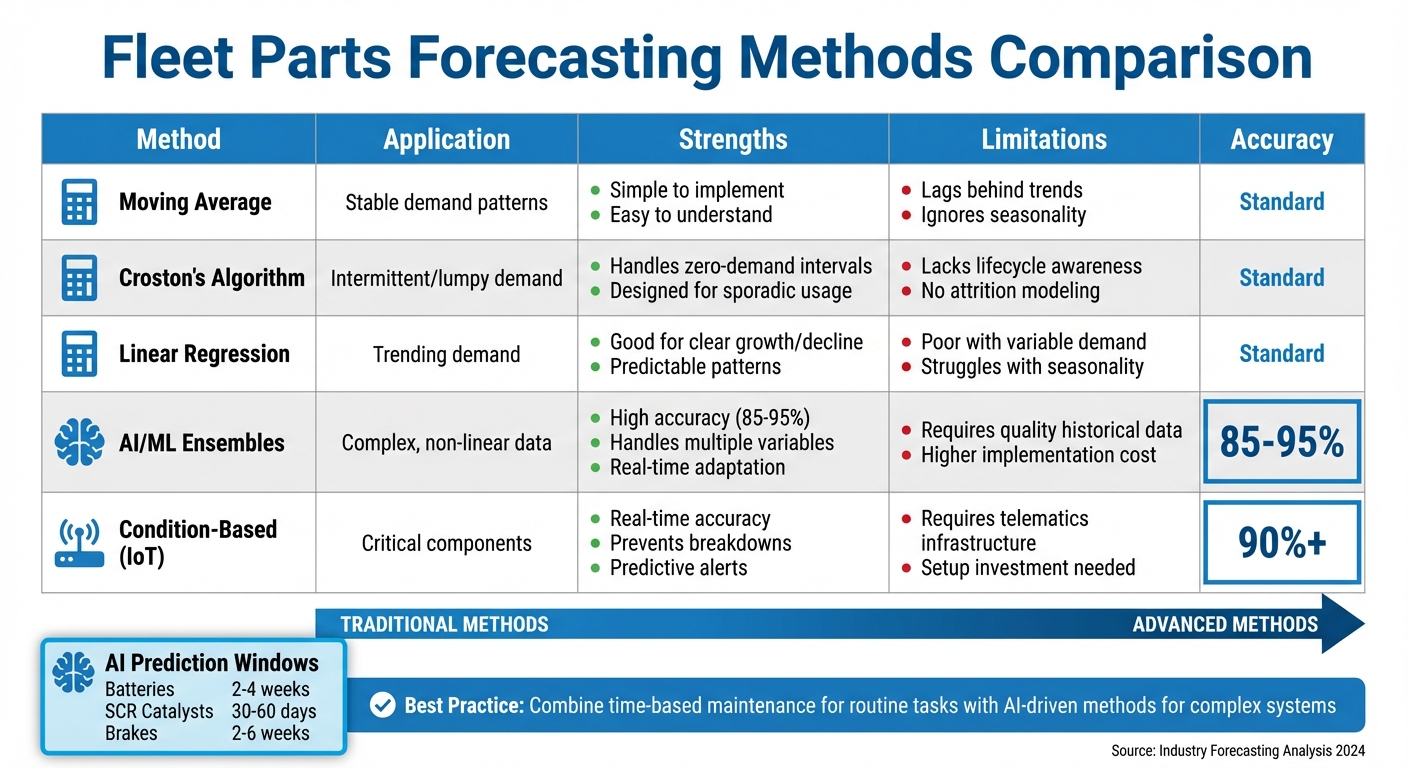

Fleet Parts Forecasting Methods Comparison: Traditional vs AI-Driven Approaches

Once you've gathered your telematics and maintenance data, the next step is choosing a forecasting method that aligns with your fleet's needs. As Phillip Slater, Founder of SparePartsKnowHow.com, aptly states:

"Essentially all inventory stocking decisions can be resolved as a forecasting problem".

Let’s break down traditional methods, AI-driven approaches, and a comparison of these tools to help you make an informed decision.

Time Series Analysis and Statistical Models

Traditional statistical methods rely on historical data, assuming that future demand will follow past trends. Techniques like moving averages smooth out fluctuations by averaging recent periods, but they can be slow to adjust to demand changes. Exponential smoothing gives more weight to recent data, improving responsiveness, but it struggles with seasonal variations. Linear regression, which calculates a trend line, works well for steady growth or decline but falters when demand is erratic or seasonal.

For spare parts with irregular or "lumpy" demand - where usage is sporadic - Croston's algorithm is particularly effective. It’s specifically tailored for managing these unpredictable patterns, making it a go-to for fleet parts management. However, all these methods share a common shortcoming: they depend entirely on past consumption data and don't incorporate real-time insights or external influences.

AI and Machine Learning Applications

AI offers a more dynamic approach, using real-time sensor data to predict potential failures weeks in advance. A reliable telematics system is crucial to ensure the accuracy of this data. For instance, GRS Fleet Telematics (https://grsft.com) provides advanced van tracking solutions that support predictive analytics.

AI-based methods can achieve prediction accuracies of 85–95%, far outperforming traditional models. Tree-based ensemble models like Random Forest, XGBoost, and CatBoost are particularly adept at processing complex, non-linear fleet data. For example, a Random Forest model achieved a Safe Mean Absolute Percentage Error (MAPE) of just 4.36%. Advanced techniques, such as Decay-Function-Blended ML (DFB-ML), combine machine learning with physical lifecycle decay models, accounting for factors like vehicle attrition and fleet dropout rates.

One compelling example is FleetDynamics Corporation, which operates 1,500 commercial vehicles. They faced an annual £4.2 million bill for brake maintenance due to unpredictable wear. By adopting AI-driven predictive analytics and digital twin technology during 2025–2026, they transitioned from time-based maintenance to schedules based on actual wear patterns. This shift significantly reduced emergency repairs and improved safety. AI can provide advance failure warnings ranging from 2–4 weeks for batteries, 30–60 days for SCR catalysts, and 2–6 weeks for brakes.

However, implementing AI requires preparation. You’ll need 12–18 months of high-quality historical data and a robust telematics infrastructure. Costs include monthly subscriptions of £12 to £40 per vehicle and setup fees ranging from £40,000 to £120,000, depending on fleet size. As Matthew Short from Fleet Rabbit explains:

"The difference [in AI forecasting] is between a doctor diagnosing symptoms and predicting disease before symptoms appear".

The following section offers a direct comparison of these forecasting methods.

Forecasting Methods Comparison

Here’s a side-by-side look at the main forecasting methods:

| Method | Application | Strengths | Limitations |

|---|---|---|---|

| Moving Average | Stable demand | Simple to implement | Lags behind trends; ignores seasonality |

| Croston's Algorithm | Intermittent/lumpy demand | Handles zero-demand intervals | Lacks lifecycle/attrition awareness |

| AI/ML Ensembles | Complex, non-linear data | High accuracy (85–95%); handles many variables | Requires high-quality historical data |

| Condition-Based | Critical components | Real-time accuracy; can prevent breakdowns | Requires IoT/Telematics infrastructure |

| Linear Regression | Trending demand | Good for clear growth/decline | Poor with variable or seasonal signals |

Many fleets find success by blending traditional time-based maintenance for routine tasks with AI-driven methods for more complex systems. To maximise your return on investment, start with high-value components that generate detailed sensor data, such as DPFs, SCRs, and batteries.

How to Implement Parts Forecasting

To get started with parts forecasting, you need reliable data, the right tools, and a well-thought-out process.

Reviewing Your Fleet's Historical Data

Begin by auditing your fleet's maintenance logs, telematics outputs, and sensor data to create a solid foundation. Collect detailed vehicle information, such as ownership history, repair records, accident data, and mileage. Accurate and comprehensive data is the backbone of dependable forecasts.

Your historical records will help you identify which parts tend to fail most often and establish usage patterns. By analysing odometer readings and engine hours, you'll uncover trends in part failures and component lifespans. This data serves as the training material for AI and machine learning systems, enabling them to predict mechanical issues on a vehicle-by-vehicle basis. Before you dive in, double-check that your data is consistent and error-free.

Start by focusing on critical components. Pay attention to parts that are costly to replace and have predictable wear patterns, such as batteries, brakes, and emissions systems like DPF and SCR. For diesel fleets, forecasting emissions system failures can offer over 90% accuracy, helping you avoid costly engine derates and maximising your return on investment.

Choosing and Integrating Forecasting Tools

Once your data is in order, the next step is choosing tools that fit your fleet's needs. Integrate your fleet management software with inventory systems to automate part orders when stock levels fall below a set threshold. A robust telematics system is a must - GRS Fleet Telematics (https://grsft.com) offers advanced van tracking solutions that support predictive maintenance with real-time data.

Start small with a pilot programme covering 10–20% of your fleet to test prediction accuracy and fine-tune AI models. For example, an LTL fleet of 2,000 trucks implemented AI-driven predictive maintenance over 18 months, cutting roadside breakdowns by 23% and reducing maintenance costs by 15%. Similarly, a construction fleet focused on hydraulic system forecasting and slashed hydraulic failures by 73%, bringing its maintenance costs down from £620,000 to £410,000 in just six months.

Make forecasting alerts part of your workflow. When a prediction is made, it should trigger an automated work order, stage the necessary parts, optimise scheduling, and complete repairs. The results should then be fed back into the AI system to improve future predictions. Involve your technicians from the outset to build trust and ensure smooth adoption. As Samsara highlights:

"Last-minute emergency repairs can be up to four times more expensive and cause unexpected downtime, so it pays to invest in a telematics solution that can alert you to maintenance issues in real-time".

After integrating your tools, continuous monitoring will be key to keeping your forecasts accurate.

Monitoring and Updating Forecasts

Forecasting isn't a "set it and forget it" process. Regular monitoring ensures your predictions stay reliable as fleet conditions evolve. Use real repair data to retrain your AI models and improve accuracy over time. The effectiveness of your telematics programme depends on how quickly you can analyse and act on the data it provides.

Set up automated reorder points, so parts orders are triggered when forecasts indicate stock levels will soon fall below safe thresholds. Incorporate supplier lead times into your planning to adjust safety stock levels and avoid running out of parts during supply chain disruptions. Keep your workshop organised, ensuring frequently used parts like brakes and filters are easily accessible.

Collaborate with your parts suppliers by sharing forecasting data. This can help set better reorder parameters and track warranty coverage on replacement parts. Working closely with suppliers ensures you're prepared when a predicted failure actually happens.

Common Forecasting Challenges and Solutions

Forecasting for parts can be tricky. Issues like fragmented data, inventory imbalances, and supply chain hiccups often throw a wrench into the process. To keep things running smoothly, each of these challenges needs a practical fix. Let’s break it down.

Solving Data Silos and Integration Issues

Data silos are a major headache. When maintenance logs, telematics data, and inventory records are scattered across separate systems, it’s hard to trust the numbers. This fragmentation often leads to errors, especially for fleets still relying on manual inventory management. As Alex Borg from Fleetio points out:

"When datasets are incomplete or out-of-date, it often becomes impossible to tell what data can be relied on and what should be disregarded".

The fix? Integration. By linking fleet management software with inventory systems and telematics, you create a single, reliable source of truth. This not only improves data accuracy but also eases the workload for staff. Ross Jephson from Chevin highlights:

"Integration also ensures data accuracy and reduces demands on administrative, finance and other personnel, in some cases even cutting staffing needs".

Tools like mobile apps and barcode scanners can instantly update stock levels, while centralised software simplifies inventory adjustments across multiple locations. Using digital tracking methods - like barcodes, QR codes, or NFC tags - makes it easy for teams to log part usage without delays. Tackling these data silos is the first step to better inventory management.

Managing Inventory Levels

Getting inventory levels just right is a balancing act. Parts often make up about 33% of fleet maintenance costs, so mistakes here can be expensive. Overstocking ties up money in unused parts, while understocking leads to downtime and costly emergency shipments.

The solution lies in predictive analytics and demand-matching. Set minimum stock thresholds for each part to trigger automatic reorders when supplies run low. Keep an eye on your stockout rate - calculated as (stockouts/total requests) × 100 - to see how often technicians are left empty-handed. Similarly, track inactive stock by measuring the percentage of inventory that hasn’t been used in a year.

Alex Borg from Fleetio offers this advice:

"The most-effective parts inventories are comprehensive without being excessive. They maintain stock levels that ensure needed components are always on hand but never end up with gluts of parts gathering dust".

Telematics data can also help. By analysing real-time mileage and engine hours, you can anticipate service needs and adjust inventory accordingly. Organising storage by system categories - like engines, brakes, or electrics - and using barcodes or QR codes can make retrieval faster and more efficient.

Challenges and Solutions Comparison

Here’s a quick look at common forecasting challenges and their solutions to help maintain smooth operations.

| Challenge | Impact | Recommended Solution |

|---|---|---|

| Data Silos | Inaccurate stock counts and manual errors | Integrate fleet management software with telematics and vendor systems |

| Stockouts | Vehicle downtime and expedited shipping | Set minimum stock levels with automated reorder alerts |

| Overstocking | Capital tied up in unused inventory | Track Inactive Stock Percentage and share parts across sites |

| Supply Chain Disruptions | Repair delays | Increase safety stock and adjust lead time parameters |

| Unclaimed Warranties | Unnecessary replacement costs | Log warranties and trigger alerts during repairs |

Measuring and Improving Forecasting Performance

Once data silos are addressed and inventory imbalances are resolved, it’s time to evaluate your forecasting performance. This step ensures your efforts lead to cost savings and smoother operations.

Key Performance Metrics

Start by assessing forecast accuracy - the difference between predicted and actual parts usage. This metric uncovers trends in your supply chain. Keep an eye on inventory turnover to ensure parts are moving efficiently without locking up too much capital. For critical parts, aim for a stockout rate of 0%, calculated as (stockouts / total requests) × 100.

Another key metric is downtime, measured by tracking the days lost waiting for parts. Improved forecasting should help reduce this number. Evaluate the planned-to-unplanned maintenance ratio; a higher rate of unplanned maintenance signals gaps in your forecasting. Finally, monitor emergency procurement costs, which include last-minute orders and expedited shipping.

| Metric | Focus | Success Indicator |

|---|---|---|

| Inventory Turnover | Financial Efficiency | High turnover without stockouts |

| Stockout Rate | Operational Readiness | 0% for critical or fast-moving parts |

| Unplanned Maintenance | Forecasting Accuracy | Fewer emergency repairs |

| Emergency Shipping Spend | Cost Control | Reduced costs for expedited freight |

Using real-time data can further sharpen these metrics, making your forecasting more effective.

Scaling Forecasting with Telematics

Telematics data offers a powerful way to scale and refine your forecasting. By integrating telematics systems, you can automate stock replenishment and make real-time adjustments to your prediction models. This approach enhances accuracy and directly impacts the metrics mentioned above. Ross Jephson from Chevin highlights the benefits:

"Service data from telematics systems can provide you with the information that will enhance your inventory optimisation plan, further reducing downtime from service".

For example, GRS Fleet Telematics (https://grsft.com) delivers continuous monitoring data, helping you spot recurring component failures before they happen. When telematics systems are linked with inventory software, replenishment becomes seamless - purchase orders are automatically triggered when stock levels dip below set thresholds.

Best Practices Summary

To improve parts forecasting, focus on integrating various data sources. Combine telematics, maintenance records, and supplier systems to minimise manual errors. Use predictive analytics to shift from reactive ordering to proactive inventory management. Regular cycle counting ensures inventory accuracy, while dynamic reorder points account for current lead times and usage trends. By continuously refining KPIs such as stockout rates and downtime, you’ll reduce costs while keeping your fleet running efficiently.

FAQs

How does AI improve fleet parts forecasting?

AI is transforming fleet parts forecasting by using machine learning to sift through massive datasets, uncover patterns, and predict demand with greater precision. Unlike older forecasting methods, AI takes into account a wide range of factors, including historical usage, telematics data, market trends, and even weather conditions. This makes the forecasts more tailored and relevant to the specific needs of your fleet.

What’s more, AI doesn’t stay static. It continuously updates forecasts based on new data, helping UK fleet managers avoid the pitfalls of overstocking or running out of critical parts. This data-driven, proactive approach not only cuts costs but also boosts operational efficiency, making fleet management smoother and vehicle maintenance more predictable.

How does using telematics data improve parts forecasting for fleets?

Integrating telematics data into parts forecasting can transform how fleets are managed. With real-time insights into vehicle health and performance, telematics allows fleet managers to anticipate when specific parts might need replacement or maintenance. This proactive strategy helps to prevent unexpected breakdowns, minimise downtime, and keep operations running smoothly.

It doesn’t stop there. Telematics also sharpens inventory management by enabling more accurate predictions of parts requirements. This means avoiding the pitfalls of overstocking or understocking, which can lead to unnecessary costs - whether from excess inventory or last-minute orders. On top of that, detailed diagnostics and data on usage patterns support predictive maintenance, making maintenance schedules more precise and helping to lower operational expenses.

In essence, telematics data streamlines planning, reduces costs, and boosts the reliability of your fleet.

How do supplier lead times impact fleet inventory management?

Supplier lead times are a key factor in fleet inventory management, directly impacting how well fleet managers can maintain optimal stock levels. When lead times are long or unpredictable, stock shortages can occur, delaying critical repairs and maintenance. This, in turn, reduces vehicle availability and disrupts overall operations.

To avoid these challenges, accurate demand forecasting is essential. By predicting parts requirements and adjusting inventory levels, fleet managers can ensure essential components are always on hand without risking overstocking. Building strong relationships with dependable suppliers and understanding their delivery schedules can also help create more reliable replenishment plans, minimising disruptions.

Additionally, tools like telematics and data analysis offer valuable insights. These technologies enable fleet managers to predict demand shifts, plan better, and ultimately save both time and money.